Trump’s World Liberty Tokens (WLFI) Get the Green Light for Trading: What You Need to Know

The cryptocurrency world is buzzing after a resounding vote paved the way for the trading of World Liberty Financial (WLFI) tokens, a cryptocurrency project associated with former US President Donald Trump. This development, following a significant vote by tokenholders, opens a new chapter for the project and raises questions about its future prospects and the broader implications for the intersection of politics and cryptocurrency.

Tokenholders Approve Trading in Landslide Victory

On Wednesday, a crucial vote concluded for WLFI tokenholders, decisively approving the transition to a tradable token. While the exact percentage isn’t publicly available from all sources yet, reports indicate a landslide victory in favor of making the tokens tradable on exchanges. This decision marks a significant shift for the project, which previously operated with limited liquidity and accessibility. The move is expected to significantly increase the token’s visibility and potentially its market capitalization.

What Does This Mean for WLFI?

The approval to trade WLFI has several potential consequences:

Increased Liquidity and Market Exposure

The primary benefit is the increased liquidity for token holders. Previously, the lack of trading options severely limited their ability to sell their holdings. Now, with the token expected to be listed on exchanges (details still pending, based on further research), investors will have significantly more flexibility. This increased liquidity often leads to higher price volatility as trading volume increases. The overall impact on the price of WLFI remains to be seen.

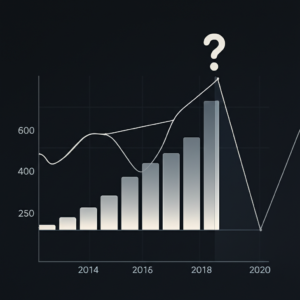

Price Volatility and Market Speculation

The introduction of WLFI to exchanges inevitably brings increased volatility. The market will react based on various factors, including news cycles, overall market sentiment in the crypto space, and Trump’s own public statements. We can anticipate a period of significant price fluctuations as trading begins.

Regulatory Scrutiny and Potential Legal Challenges

Given the project’s association with a high-profile political figure, increased regulatory scrutiny is a likely outcome. The Securities and Exchange Commission (SEC) in particular, has been highly active in regulating crypto projects and could potentially take interest in WLFI, depending on the specifics of its offering and compliance with securities laws. Further legal challenges could also arise, particularly regarding the initial offering and token distribution.

The Future of WLFI

The long-term success of WLFI hinges on several factors, including market adoption, the project’s overall utility (if any is provided), and the level of sustained investor interest. The project will need to demonstrate tangible value propositions to maintain sustained growth in the competitive cryptocurrency market.

Conclusion: What to Watch For

The tradability of WLFI tokens marks a notable moment for the cryptocurrency industry, blending political figures with the volatile crypto space. Whether this experiment in combining politics and cryptocurrency will be successful remains uncertain. It will be crucial to monitor the following:

- Exchange Listings: Which exchanges will list WLFI and when?

- Price Volatility: How will the price of WLFI react to increased trading volume?

- Regulatory Action: What is the potential for SEC investigation or other regulatory action?

- Long-Term Sustainability: Can WLFI establish itself as a viable project beyond its initial hype?

Bullet-Point Summary:

- WLFI tokens, linked to Donald Trump, are now approved for trading.

- A landslide vote among tokenholders triggered this transition.

- Increased liquidity, volatility, and regulatory scrutiny are expected.

- The long-term success of WLFI depends on market adoption and value proposition.