Ripple’s XRPL Volume Dip: Is Off-Chain Settlement the Real Story?

The Ripple ecosystem, despite boasting a considerable number of financial institutional partnerships, has recently faced scrutiny regarding the relatively low transaction volume on its native XRP Ledger (XRPL). This has sparked debate and prompted Ripple CTO David Schwartz to offer an explanation: many bank transactions are happening off-chain. But does this explanation fully address concerns about transparency and the actual adoption of XRP?

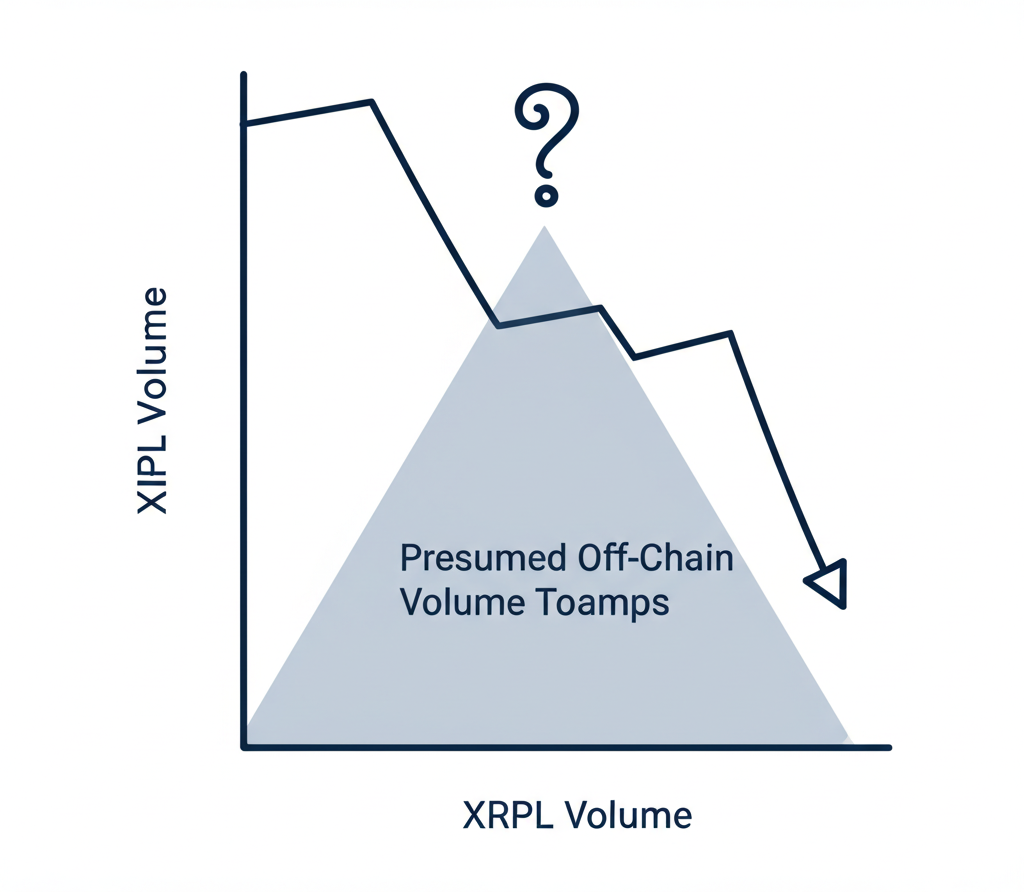

The Mystery of Low XRPL Volume

Recent data indicates a significant drop in XRPL activity, with some estimates placing the decline at 30-40%. This contrasts sharply with Ripple’s claims of hundreds of banking partners utilizing its technology for cross-border payments. The discrepancy has raised eyebrows within the crypto community, leading to questions about the true scale of XRP’s practical application.

Schwartz’s Explanation: Off-Chain Settlements

In response to the criticism, Ripple CTO David Schwartz has pointed to the prevalence of off-chain settlement methods. He argues that while the actual transactions aren’t directly visible on the XRPL, the underlying technology and infrastructure are still heavily involved. This approach, he suggests, offers benefits such as enhanced privacy and faster transaction speeds for large institutions.

However, this explanation doesn’t fully alleviate concerns. While off-chain settlements might explain the lower XRPL volume, they simultaneously reduce transparency and make it difficult to independently verify the claimed volume of transactions facilitated by Ripple’s technology. The lack of publicly available data on these off-chain settlements leaves room for skepticism.

The Importance of Transparency in the Crypto Space

Transparency is a cornerstone of the cryptocurrency ethos. Public blockchains, like Bitcoin’s, provide a readily auditable record of all transactions. The reliance on off-chain settlements for a significant portion of Ripple’s claimed transactions raises concerns about accountability and the potential for obfuscation. This lack of clear visibility could hinder wider adoption and erode trust among potential users and investors.

Comparing XRPL to Other Payment Networks

To put the low XRPL volume in perspective, it’s crucial to compare it to other established payment networks. While Ripple aims for a different niche in cross-border payments, the contrast between the volume on XRPL and the scale of global transactions highlights the significant gap between the claims and the on-chain data. Further analysis comparing the transaction throughput and costs with SWIFT and other players is necessary to understand its competitive positioning.

The Future of XRP and Ripple’s Strategy

The debate surrounding XRPL’s volume underscores the ongoing challenges for Ripple in balancing the needs of its institutional clients with the principles of transparency expected in the cryptocurrency space. The future success of XRP likely hinges on finding a way to increase transparency and public visibility without sacrificing the privacy and speed benefits valued by its banking partners. This may involve exploring innovative solutions to bridge the gap between on-chain and off-chain activity, possibly incorporating more sophisticated data aggregation and reporting.

Key takeaways:

- XRPL transaction volume has significantly declined recently.

- Ripple CTO defends this by highlighting the prevalence of off-chain settlements with its banking partners.

- This reliance on off-chain activity raises concerns about transparency and verifiability.

- The lack of publicly accessible data on these off-chain transactions fuels skepticism.

- Ripple needs to balance the need for privacy with the requirement for transparency to gain wider adoption.