Real-World Assets (RWAs) in DeFi: Stuck in the Reflection, Not Building the Future

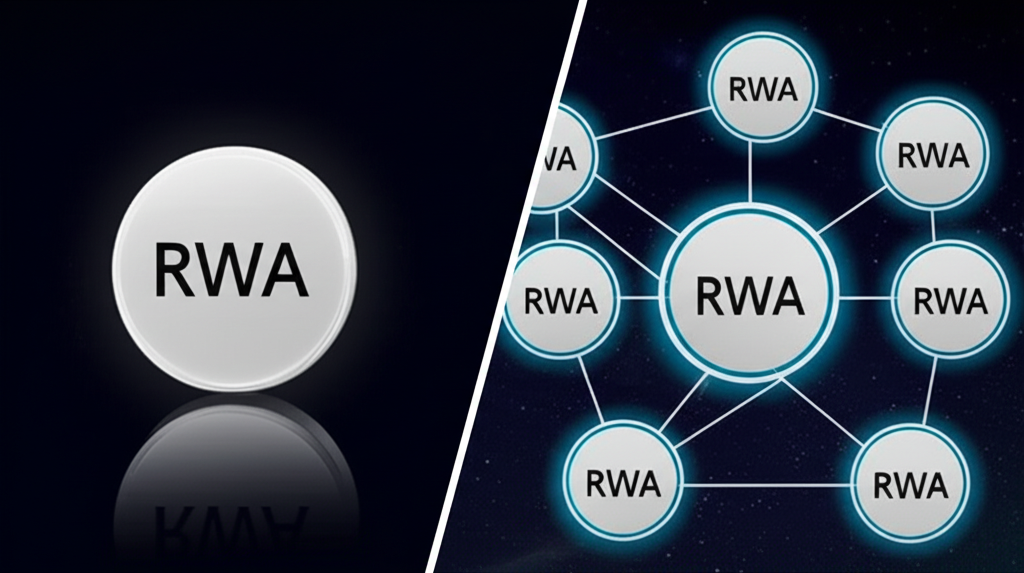

The decentralized finance (DeFi) space has shown immense potential, but its integration with real-world assets (RWAs) remains a significant hurdle. A recent article highlights a crucial issue: most RWAs are acting as mere reflections of their real-world counterparts, failing to become the composable, interconnected building blocks necessary for DeFi’s next evolution. This lack of interoperability severely limits the potential of DeFi to impact the broader financial landscape.

The Current State of RWA Integration in DeFi

The integration of RWAs into DeFi has been slower than anticipated. While projects are experimenting with tokenizing real-world assets like real estate, commodities, and intellectual property, the majority remain siloed and lack the crucial interoperability needed to unlock their true potential. Instead of acting as modular components within a broader DeFi ecosystem, these RWAs often function as isolated, self-contained units.

This “mirror” approach, where digital representations simply mimic real-world assets without seamless interaction, creates significant limitations. The inability to easily combine and leverage different RWAs within DeFi protocols hinders the development of innovative financial products and services. For example, imagine a DeFi application that allows users to borrow against a portfolio of fractionalized real estate and precious metals. The current state of RWA integration makes such an application incredibly challenging to build.

The Need for Standardized Building Blocks

The core problem, as the article highlights, is the lack of standardized building blocks. Currently, each RWA tokenization project operates in its own isolated ecosystem. This fragmentation makes it difficult to create complex, interconnected DeFi applications that leverage the diverse range of real-world assets. There’s a pressing need for interoperability standards and protocols to allow different RWAs to interact smoothly.

Towards a Composable Future for RWAs in DeFi

To overcome these challenges, the industry needs a concerted effort to develop standardized protocols and frameworks for RWA tokenization. This includes:

- Interoperability standards: Developing common protocols that allow different RWA tokens to interact seamlessly.

- Improved data oracles: Reliable and secure oracles are critical for providing accurate and up-to-date information on the underlying real-world assets.

- Enhanced regulatory clarity: Clearer regulatory frameworks are needed to provide legal certainty and encourage greater adoption of RWA tokenization.

- Open-source development: Collaborative open-source projects can help accelerate the development of interoperable RWA solutions.

Without these foundational elements, the potential of RWAs in DeFi will remain unrealized. Moving beyond simple mirroring and towards true composability is crucial for unlocking the transformative potential of merging traditional finance with decentralized technologies.

Summary:

- Most RWAs in DeFi are currently isolated and lack interoperability.

- This limits the creation of sophisticated DeFi applications utilizing diverse real-world assets.

- Standardized protocols and frameworks are crucial for unlocking the full potential of RWAs in DeFi.

- Improved data oracles and regulatory clarity are also essential.