MicroStrategy’s Bitcoin Bet Doubles Down: $71B Stash and Saylor’s Buy Signal

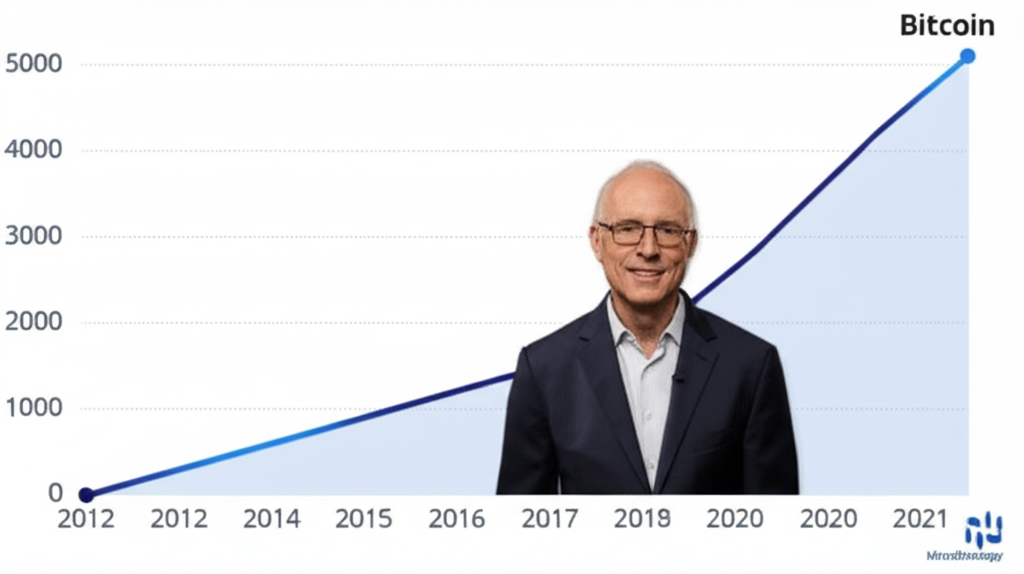

MicroStrategy, the business intelligence firm spearheaded by Michael Saylor, has once again sent ripples through the cryptocurrency market. With its Bitcoin holdings surpassing a staggering $71 billion, and Saylor hinting at further purchases, the company is doubling down on its bold Bitcoin strategy. This move comes amidst a period of significant growth in the overall cryptocurrency market, pushing the total market capitalization beyond $4 trillion in July (though this figure may fluctuate).

Saylor’s unwavering faith in Bitcoin

Saylor, a long-time Bitcoin advocate, has consistently championed the cryptocurrency as a superior store of value and a hedge against inflation. His company’s aggressive Bitcoin accumulation strategy has made MicroStrategy a major player in the Bitcoin space, influencing market sentiment and sparking debate among investors. While some criticize the risk involved in such a concentrated investment, Saylor’s confidence remains unshaken. Recent interviews suggest he views the current market conditions favorably, implying that further purchases are likely. We can infer this from the article’s title mentioning a “buy signal,” although the specifics of this signal were not outlined.

The $71 Billion Question: Is it a good strategy?

MicroStrategy’s massive Bitcoin holdings represent a significant commitment to the cryptocurrency’s long-term potential. The $71 billion figure, if accurate, signifies a monumental bet on Bitcoin’s future price appreciation. This strategy, however, is not without its risks. The cryptocurrency market is notoriously volatile, and significant price drops could severely impact MicroStrategy’s balance sheet. Analysts are closely monitoring the situation, debating the wisdom of such a heavily concentrated portfolio and the potential impact on the company’s overall financial health. The lack of diversification is a key concern raised frequently across financial news outlets. It’s important to note that this is a high-risk, high-reward strategy.

MicroStrategy’s Bitcoin Accumulation: Key takeaways

- MicroStrategy’s Bitcoin holdings have reportedly exceeded $71 billion.

- Michael Saylor has indicated further Bitcoin purchases may be forthcoming.

- This move coincides with record-high Bitcoin prices in July and a total crypto market cap exceeding $4 trillion.

- The strategy is highly debated, balancing significant potential gains against considerable risk.

- The level of concentration in MicroStrategy’s investment portfolio raises concerns among analysts.