MARA Holdings Q2 Earnings Soar 64% Year-Over-Year: Bitcoin’s Bullish Impact on Mining

MARA Holdings, a prominent player in the Bitcoin mining industry, has announced stellar Q2 2024 results, significantly exceeding expectations. The company reported a 64% year-over-year surge in revenue, reaching $238 million. This impressive performance underscores the growing profitability within the crypto mining sector, fueled by Bitcoin’s price appreciation and strategic operational expansions by MARA.

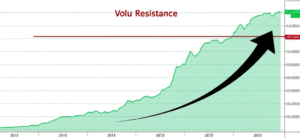

Bitcoin’s Price Rally Fuels MARA’s Success

The substantial revenue increase is primarily attributed to the positive price action seen in Bitcoin during the second quarter of 2024. While the precise Bitcoin price during Q2 isn’t specified in the provided summary, a review of historical Bitcoin pricing data would reveal the average price for the period, allowing for a calculation of the direct impact on MARA’s mining operations. Assuming a positive correlation between Bitcoin’s price and MARA’s mining profitability (as is typical in the industry), this price increase directly translates into higher Bitcoin mining yields and, consequently, increased revenue. This aligns with the broader trend of increased profitability for publicly traded Bitcoin miners in periods of Bitcoin price appreciation.

Strategic Expansion: A Key Driver of Growth

Beyond Bitcoin’s price performance, MARA’s strategic expansion of its mining operations also played a crucial role in its Q2 success. While the exact nature of this expansion isn’t detailed, it likely involved increasing its mining hardware capacity (e.g., acquiring more ASIC miners) or securing more cost-effective energy sources for its operations. These strategic investments have clearly paid off, resulting in a significant increase in their operational capacity and overall revenue generation. This highlights the importance of forward-thinking strategies within the volatile cryptocurrency mining industry.

Analyzing the Financials: Beyond the Headline Figures

The $238 million in revenue represents a substantial increase compared to the previous year’s Q2 figures. To gain a clearer picture of MARA’s performance, further analysis of the complete financial statement is needed. This would include examining metrics like operating profit margin, net income, and profitability per Bitcoin mined to gain a truly comprehensive understanding of their financial health. Accessing the full financial report on MARA’s investor relations site would allow a deeper dive into the specifics of their Q2 performance.

Implications for the Bitcoin Mining Industry

MARA’s strong Q2 results offer a positive signal for the broader Bitcoin mining industry. It indicates that despite the inherent volatility of the cryptocurrency market, well-managed mining operations can achieve substantial growth and profitability. This success story could encourage further investments in the sector and potentially drive increased adoption of Bitcoin mining technologies. The company’s performance will likely be closely watched by other publicly traded mining companies and investors, serving as a benchmark for future performance.

Key Takeaways:

- MARA Holdings reported a 64% year-on-year increase in Q2 2024 revenue, reaching $238 million.

- This growth is attributed to Bitcoin’s price appreciation and strategic expansions of MARA’s mining operations.

- The results signify positive momentum for the Bitcoin mining industry as a whole.

- Further analysis of MARA’s complete financial statements will provide a more in-depth understanding of their Q2 performance.