Kraken’s Q2 Earnings Dip: Diversification Strategy or Sign of Trouble?

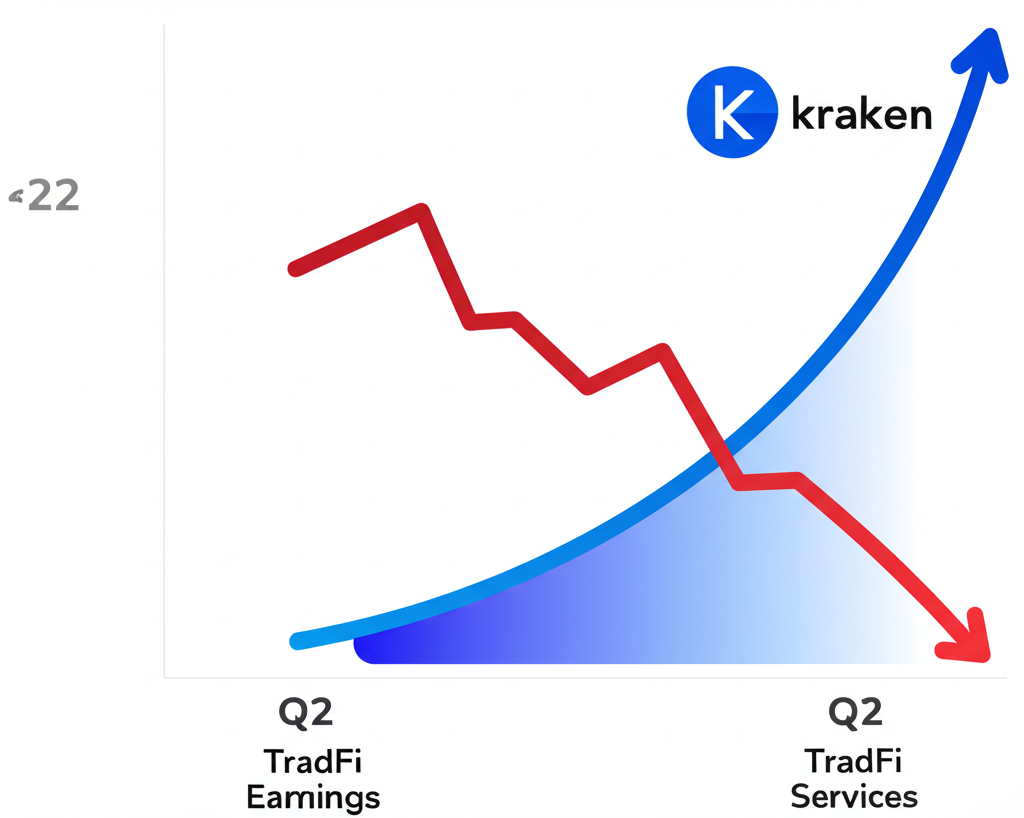

Kraken, one of the world’s largest cryptocurrency exchanges, reported a dip in Q2 earnings, a development that has sparked debate within the crypto community. While the exchange highlights its strategic expansion beyond crypto into traditional finance (TradFi) as a key driver of future growth, the results raise questions about the immediate impact of this diversification strategy. This article delves deeper into Kraken’s Q2 performance and its implications for the future.

A Strategic Shift Towards TradFi

Kraken’s Q2 earnings report, while showing a decrease compared to previous quarters (specific figures are not available from the provided summary, further research would be needed to obtain exact data points), emphasizes the company’s increasing focus on TradFi products. This strategic move, in light of the ongoing crypto winter and regulatory uncertainty, aims to diversify revenue streams and potentially pave the way for a highly anticipated IPO, targeting a $15 billion valuation according to reports. This aggressive expansion might be partially responsible for the dip in Q2 earnings as resources are allocated to developing and marketing new products.

The Impact of Macroeconomic Factors

The reported earnings dip is likely influenced by broader macroeconomic factors affecting the entire crypto market. The continued bear market, coupled with regulatory crackdowns in various jurisdictions, has significantly impacted trading volume and overall market sentiment. While Kraken’s diversification efforts are aimed at mitigating such market volatility, the transition period naturally involves adjustments and potential short-term losses.

Looking Ahead: IPO Ambitions and Long-Term Prospects

Kraken’s ambition to go public underlines its belief in the long-term viability of its expanded business model. A successful IPO hinges on demonstrating sustainable growth and profitability, even amidst short-term fluctuations. The inclusion of TradFi offerings positions Kraken for growth in a less volatile market segment, providing a potential safety net against future crypto market downturns. However, successful navigation of the regulatory landscape and demonstrating consistent returns from their expanded operations are crucial to meet this ambitious valuation.

Analyzing the Numbers (Further Research Needed)

While the provided summary doesn’t offer specific financial data, further online research into Kraken’s official Q2 earnings report and financial news outlets would reveal detailed figures on revenue, trading volume, expenses, and net income. This information is critical for a thorough analysis of their performance and the actual impact of their diversification efforts. Comparing this Q2 data with previous quarters would provide valuable insight into the trajectory of the company’s growth.

Key Takeaways:

- Kraken experienced a dip in Q2 earnings.

- The company is actively expanding into TradFi products.

- This diversification is a strategic move aimed at mitigating crypto market volatility and facilitating a potential $15 billion IPO.

- Macroeconomic factors and the transition period are likely contributors to the earnings dip.

- Further research is needed to obtain precise financial data for a comprehensive analysis.