India at a Bitcoin Crossroads: Will the Rupee Embrace the Crypto King?

India, a nation known for its rapid technological adoption and burgeoning fintech sector, finds itself at a critical juncture regarding Bitcoin. The global conversation around Bitcoin’s role in national reserves, fueled by tentative explorations from countries like the US, has brought this debate squarely into the Indian spotlight. The question is: will India, a country with a complex history with cryptocurrencies, ultimately embrace Bitcoin as a strategic asset for its national reserves?

The Global Context: Bitcoin’s Rise in Geopolitical Strategy

The potential inclusion of Bitcoin in national reserves is no longer a fringe idea. While no major country has yet fully committed to holding significant BTC reserves, the ongoing discussions reflect a shift in global macroeconomic thinking. The US, for example, has explored the implications of Bitcoin diversification, and its moves, however tentative, send ripples through the international financial community. This global context creates pressure on nations like India to at least consider the potential benefits and risks. The perceived stability of traditional fiat currencies is increasingly questioned, particularly in the face of geopolitical uncertainty and inflationary pressures.

Weighing the Pros and Cons for India

For India, the decision is fraught with complexities. The potential upsides include:

- Diversification and Resilience: Adding Bitcoin to its reserves could enhance the resilience of India’s portfolio against fluctuations in traditional assets.

- Digital Leadership: Embracing Bitcoin would position India as a leader in the evolving digital asset landscape.

- Hedging Against Inflation: Bitcoin’s deflationary nature could provide a hedge against inflationary pressures.

However, significant challenges remain:

- Regulatory Uncertainty: India’s cryptocurrency regulatory framework is still evolving, creating considerable uncertainty. The Reserve Bank of India (RBI) has historically held a cautious stance toward crypto.

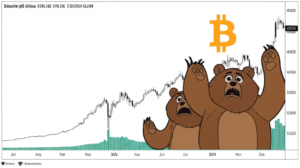

- Volatility: Bitcoin’s price volatility is a major concern, posing significant risks to national reserve stability.

- Technological Considerations: Managing and securing large Bitcoin holdings requires specialized expertise and infrastructure.

India’s Current Crypto Landscape: A Complex Relationship

India’s relationship with cryptocurrencies has been marked by both enthusiasm and caution. While the government has not outright banned Bitcoin, its regulatory stance remains uncertain. This uncertainty has created a climate of ambiguity that hinders the broader adoption and integration of cryptocurrencies into the mainstream financial system. The lack of a clear regulatory framework has also discouraged institutional investment in the space. This situation contrasts sharply with the enthusiasm shown by many individual investors in India’s vibrant crypto market.

The Path Forward: A Balancing Act

The question of whether India will add Bitcoin to its national reserves remains unanswered. The decision will require careful consideration of the risks and rewards, a clear regulatory framework, and a deep understanding of the complexities of the crypto market. A phased approach, perhaps starting with pilot programs or smaller-scale investments, could be a strategic way to navigate the uncertain landscape. Ultimately, India’s decision will have implications far beyond its borders, shaping the future of cryptocurrency’s role in global finance.

Summary:

- Global discussions about Bitcoin in national reserves are forcing India to consider its stance.

- Potential benefits for India include diversification, digital leadership, and inflation hedging.

- Challenges include regulatory uncertainty, price volatility, and technological hurdles.

- India’s current crypto landscape is characterized by a complex relationship between regulatory caution and public enthusiasm.

- The future path for India’s Bitcoin policy will involve carefully weighing risks and rewards.