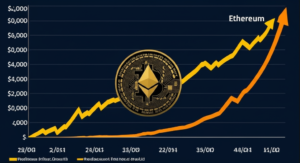

Ethereum’s Price Under Pressure: Analyst Warns of “Meaningful Unwinding”

The cryptocurrency market is known for its volatility, and Ethereum (ETH), the second-largest cryptocurrency by market capitalization, is currently facing headwinds. A recent analysis suggests that ETH’s price could be vulnerable to a significant correction, potentially impacting the broader Ethereum ecosystem.

Surging Borrowing Rates: A Warning Sign?

According to a crypto researcher at Cointelegraph, the recent surge in borrowing rates on the Ethereum network is a cause for concern. These elevated rates indicate increased demand for ETH, which is often used as collateral in decentralized finance (DeFi) protocols. While high demand can be positive, the current situation is perceived differently. The analyst suggests this increased demand could be unsustainable, leading to a “meaningful unwinding.”

This “unwinding” refers to a potential cascade effect where users needing to repay loans might be forced to liquidate their ETH holdings to meet margin calls. This mass liquidation could create a significant sell-off, driving down the price of ETH. While the exact timing and magnitude of this potential correction remain uncertain, the warning highlights the risks associated with the current market dynamics. This isn’t unprecedented; similar events in the DeFi space have caused price drops in the past. For instance, the collapse of several lending protocols in 2022 created significant ripple effects across the market.

Ripple Effects Across the Ecosystem

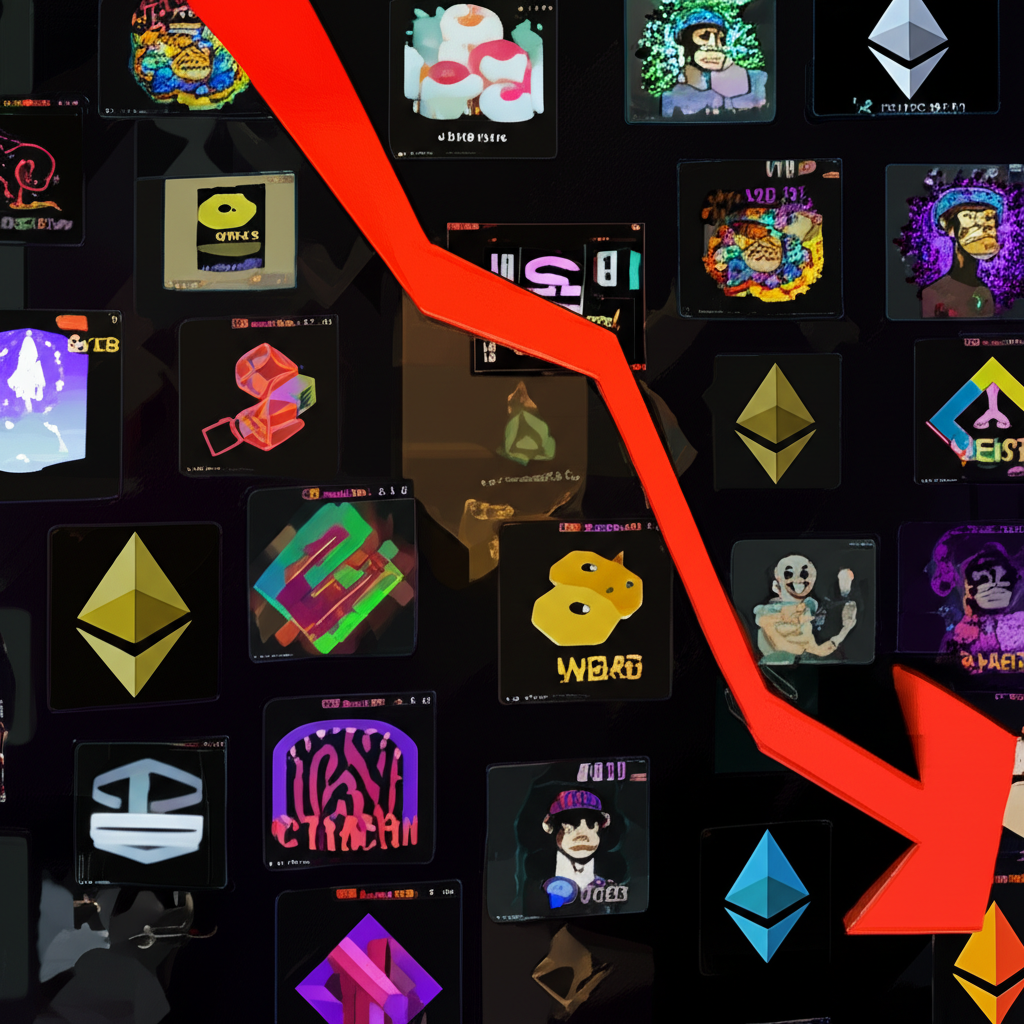

The implications of a potential ETH price correction extend beyond just the price itself. The Ethereum ecosystem is vast, encompassing numerous DeFi applications, NFTs, and other projects. A downturn in ETH’s price could lead to:

- Reduced DeFi activity: Lower ETH prices could reduce the collateral value used in DeFi lending and borrowing, potentially leading to decreased liquidity and activity.

- Impact on NFT markets: The NFT market, heavily reliant on ETH for transactions, could also suffer from reduced trading volume and lower prices.

- Widespread market uncertainty: A significant ETH price drop could trigger a wider sell-off in the cryptocurrency market, impacting the prices of other cryptocurrencies.

Analyzing the Current Market Conditions

To understand the analyst’s warning, we need to consider several factors influencing the current Ethereum market. These include:

- Macroeconomic conditions: Global economic uncertainty can impact investor sentiment, potentially leading to risk-averse behavior and sell-offs in the crypto market.

- Regulatory landscape: Ongoing regulatory scrutiny of the cryptocurrency industry can create uncertainty and impact investor confidence.

- Technological developments: Positive developments, such as the successful completion of the Shanghai upgrade, can impact the price positively, while negative news like security vulnerabilities can have an inverse effect.

It’s crucial for investors to carefully monitor these factors and assess the risks associated with holding ETH. Diversification and risk management strategies are essential to navigate this potentially volatile market.

Summary:

- High borrowing rates on the Ethereum network raise concerns.

- An analyst predicts a potential “meaningful unwinding” of ETH positions.

- This could trigger a significant price correction and ripple effects across the Ethereum ecosystem.

- Market conditions, regulations, and technological factors should be carefully considered.

- Investors need to stay informed and implement prudent risk management strategies.