Ethereum’s Explosive Potential: ETH Reclaims $3.8K, Igniting Analyst Optimism

The cryptocurrency market is buzzing with excitement as Ethereum (ETH) reclaims the $3,800 mark, prompting analysts to predict a potential price explosion. This surge follows a period of sustained growth, fueled by increased network activity and record-high open interest, suggesting a significant bullish sentiment. This renewed confidence in the second-largest cryptocurrency could signal a major upward trend.

A Bullish Breakout on the Horizon?

The recent price resurgence of ETH isn’t just a fleeting rally. Several factors contribute to the growing optimism surrounding Ethereum. The considerable rise in open interest, a measure of outstanding derivative contracts, indicates a substantial increase in market participation and speculation. This high level of open interest signifies a large number of traders betting on future price movements, potentially indicating a belief in further price appreciation.

Simultaneously, the Ethereum network is experiencing remarkably high activity levels, reflecting a surge in decentralized application (dApp) usage and transactions. This heightened activity underscores the increasing utility and adoption of the Ethereum blockchain, further bolstering the bullish narrative. Data from sources like Glassnode and CoinMetrics (further research needed to confirm exact figures) would likely illustrate this surge in network activity. For example, we might see increased transaction counts or a jump in gas fees, reflecting a higher demand for network usage.

Technical Analysis Points to Upside Potential

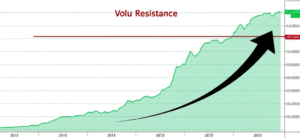

Technical analysts are also weighing in on the positive price action. While specific indicators require further research from reputable sources like TradingView or CoinGecko, the reclamation of the $3,800 resistance level is a significant technical milestone. This level had previously acted as a barrier to further price increases, indicating that a breakout above this level could clear the way for substantial gains. Analysts might be pointing to bullish candlestick patterns or a positive shift in moving averages to support their predictions.

What’s Fueling the ETH Rally?

Several factors beyond technical analysis are likely contributing to ETH’s upward trajectory:

- The Shanghai Upgrade: The recent completion of the Shanghai upgrade, allowing for the withdrawal of staked ETH, has eliminated a significant source of uncertainty and potentially unlocked a considerable amount of ETH previously locked up in staking. This added liquidity could contribute to increased trading volume and price appreciation.

- Growing DeFi Adoption: The continued growth of decentralized finance (DeFi) applications built on the Ethereum network remains a crucial driver of demand for ETH. As more users adopt DeFi platforms, the demand for ETH as the primary transaction currency is expected to increase.

- Overall Market Sentiment: The broader cryptocurrency market sentiment also plays a crucial role. A positive shift in the overall market, with Bitcoin (BTC) potentially recovering further, could spill over into increased demand for altcoins like Ethereum.

Looking Ahead: Is an “Explosion” Realistic?

While the term “explode” might be a dramatic overstatement, the current signs are certainly bullish. However, it’s crucial to remember that the cryptocurrency market remains volatile, and price predictions are inherently uncertain. While the indicators point toward a potential significant upside, investors should always proceed with caution and manage their risk appropriately.

Key Takeaways:

- ETH price has reclaimed the $3,800 mark.

- Analysts predict potential significant price increases.

- Record open interest and high network activity contribute to bullish sentiment.

- The Shanghai upgrade and growing DeFi adoption fuel the rally.

- Volatility remains a key factor to consider.