Ethereum’s Decade of Dominance? Ether Machine Founder Claims ETH Outperformed BTC

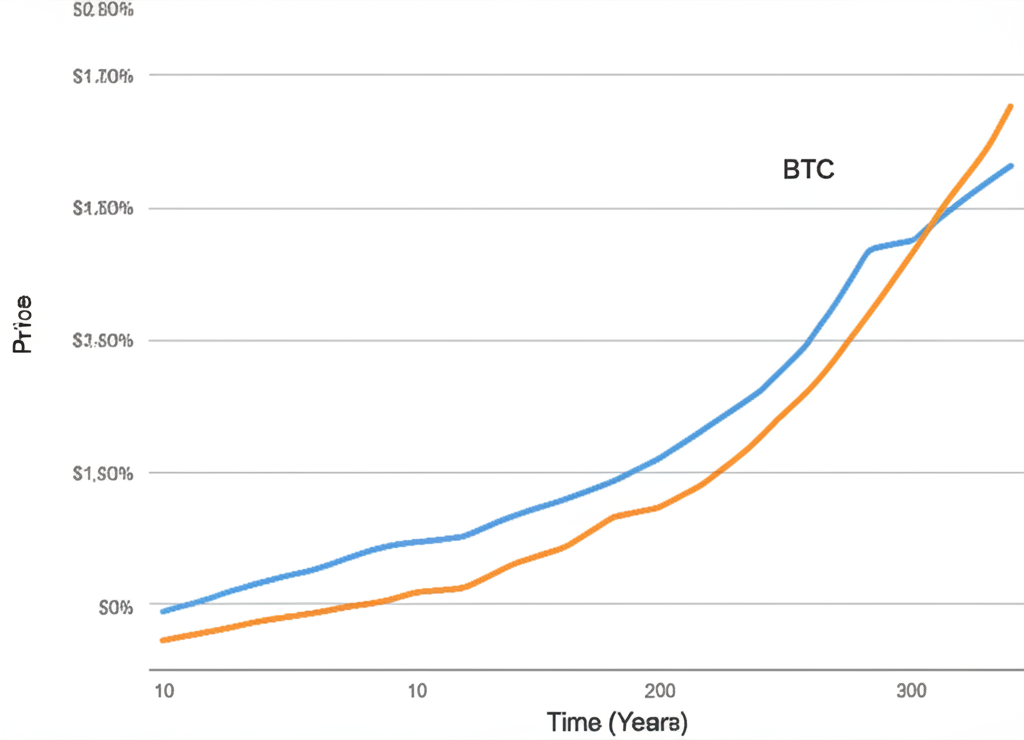

The cryptocurrency world is abuzz with a bold claim from a prominent figure: Andrew Keys, founder of Ether Machine, asserts that Ethereum (ETH) has significantly outperformed Bitcoin (BTC) over the past decade. This statement, made in a recent interview, has ignited a fresh debate about the relative merits of the two leading cryptocurrencies.

Keys’ Bold Assertion: ETH’s Superior Performance

Keys, a self-described “Ethereum maxi,” declared his unwavering belief in Ethereum’s superiority, likening the choice between Bitcoin and Ethereum to choosing between a landline phone and an iPhone. This analogy underscores his conviction that Ethereum’s functionality and potential for innovation dwarf Bitcoin’s, even if Bitcoin maintains its position as the dominant cryptocurrency by market capitalization. While he didn’t provide specific performance figures in the original article, his statement implies a significant outperformance of ETH compared to BTC based on a ten-year period.

Analyzing the Claim: A Deeper Dive

While Keys’ assertion is provocative, verifying its accuracy requires a detailed analysis of both ETH and BTC price performance over the past 10 years. Data from sources like CoinGecko and CoinMarketCap would be crucial in comparing returns, accounting for the respective launch dates of both assets. Furthermore, an apples-to-apples comparison should factor in various aspects including initial investment amounts, transaction costs and volatility.

Several factors could contribute to ETH’s potential outperformance, including:

- The explosive growth of the DeFi ecosystem: Ethereum’s role as the foundation for decentralized finance (DeFi) applications has undeniably propelled its growth and value. The emergence of DeFi lending, borrowing, and yield farming platforms built on Ethereum has attracted substantial investment.

- The rise of NFTs: Ethereum’s dominance in the Non-Fungible Token (NFT) market has also contributed to its price appreciation. The explosive popularity of digital collectibles and art on Ethereum-based marketplaces has driven significant demand.

- Ethereum’s transition to Proof-of-Stake: The shift to a more energy-efficient consensus mechanism could be viewed positively by investors, leading to increased adoption and price appreciation.

However, it’s important to note that Bitcoin still holds significant advantages. Its first-mover advantage, strong brand recognition, and reputation as a store of value continue to attract investors. Direct price comparison without considering risk-adjusted returns (Sharpe Ratio, for instance) might be misleading.

The Ongoing Bitcoin vs. Ethereum Debate

This latest statement from Keys reignites the long-standing debate surrounding Bitcoin and Ethereum. While Bitcoin often retains the spotlight as the original and most widely recognized cryptocurrency, Ethereum’s expanding ecosystem and utility continue to draw significant attention. The debate is far from settled, and both cryptocurrencies are expected to play significant roles in the future of finance.

Market Reaction and Future Outlook

The cryptocurrency market’s reaction to Keys’ statement will likely depend on the overall market sentiment and the release of concrete data supporting his claims. Further analysis and independent verification of the performance comparison are needed to assess the validity of his statement. The ongoing debate between Bitcoin maximalists and Ethereum maximalists will undoubtedly continue to shape the narrative surrounding both cryptocurrencies.

Bullet Point Summary:

- Andrew Keys, founder of Ether Machine, claims ETH outperformed BTC over the past 10 years.

- He uses the iPhone vs. landline analogy to highlight Ethereum’s perceived superiority.

- Verification requires detailed price analysis considering initial investment, transaction fees, and volatility.

- Ethereum’s success is partially attributed to DeFi, NFTs, and the shift to Proof-of-Stake.

- Bitcoin maintains advantages like first-mover status and store-of-value perception.

- The debate over Bitcoin vs. Ethereum remains central to the crypto narrative.