Ethereum’s $4K Rally Stalls: Derivatives Market Signals Caution

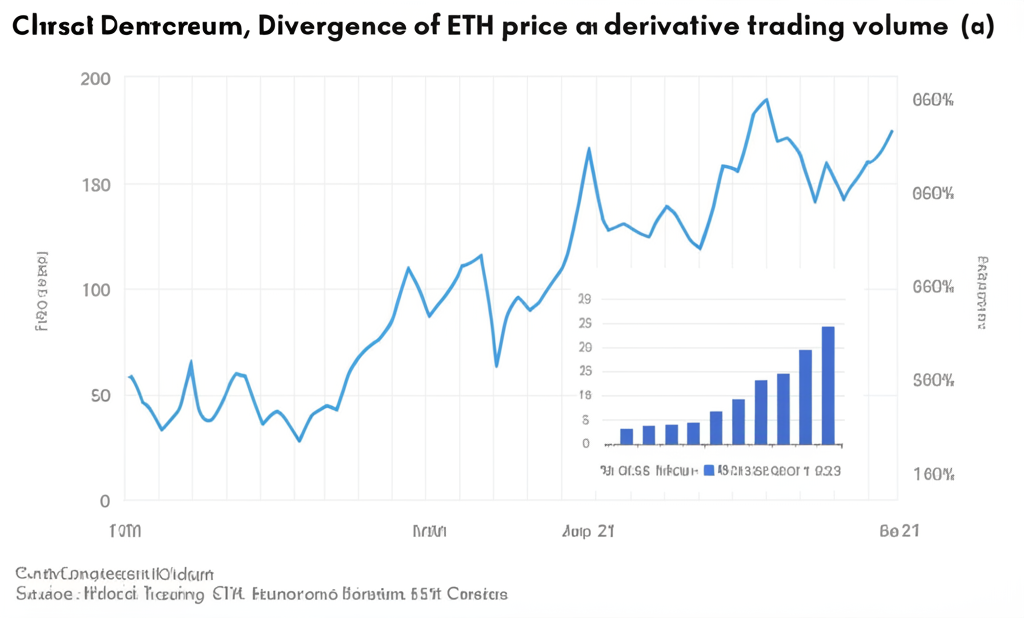

The recent surge in Ethereum (ETH) price, fueled in part by positive ETF developments, has failed to ignite the derivatives market, sparking concerns about the sustainability of a rally towards $4,000. While some analysts remain optimistic, the lack of momentum in futures and options trading raises significant questions about the strength of the current bullish sentiment.

Weak Derivatives Activity Casts Shadow on ETH’s Future

Despite inflows into Ethereum-based exchange-traded funds (ETFs), suggesting growing institutional interest, the derivatives market paints a contrasting picture. The volume of ETH futures contracts and options trading hasn’t seen a corresponding increase, indicating a lack of conviction amongst professional traders. This divergence suggests that the recent price increase may be driven primarily by short-term speculative trading rather than a fundamental shift in market sentiment.

Competitive Landscape and Network Activity Weigh In

Several factors could be contributing to the muted response in the derivatives market. The persistent competition from other layer-1 blockchains, such as Solana and Cardano, continues to put pressure on Ethereum’s dominance. Furthermore, the article suggests that network activity hasn’t shown significant growth to justify a sustained price rally. Lower-than-expected transaction volumes and decentralized application (dApp) usage could be undermining the bullish narrative.

One can infer from the limited information that while ETF inflows are positive, they alone aren’t enough to drive substantial activity in the derivatives market. This lack of participation from professional traders, who often use derivatives to hedge risks or speculate on price movements, raises concerns about the potential for a sharp price correction. For example, if a significant amount of short positions were opened prior to the price increase, a sharp drop could trigger massive liquidations, further depressing the price.

We need to investigate what those ETF inflows are. If it’s just a few million dollars, that is not enough to move the overall market sentiment. We need additional data to confirm this assumption and compare it against previous ETF inflows and their impact.

What’s Next for Ethereum?

The situation underscores the complexity of predicting cryptocurrency price movements. While the overall trend might be positive in the long term, short-term price fluctuations can be unpredictable and influenced by a multitude of factors. The lack of momentum in the Ethereum derivatives market serves as a cautionary tale, highlighting the importance of considering multiple indicators before making investment decisions. A sustained bullish rally will require more than just ETF inflows; increased network activity, improved scalability, and potentially a shift in the broader crypto market sentiment are all crucial factors.

Key Takeaways:

- Ethereum’s recent price increase hasn’t translated into significant activity in the derivatives market.

- ETF inflows, while positive, are insufficient to drive sustained bullish momentum on their own.

- Competition from other blockchains and weak network activity could be hindering a strong rally.

- The lack of derivative market participation raises concerns about the sustainability of a $4,000 price target.

- Traders should exercise caution and consider diverse data points before making investment decisions.