Crypto Market Cap Inches Towards $4 Trillion, Rivaling Apple’s Market Dominance

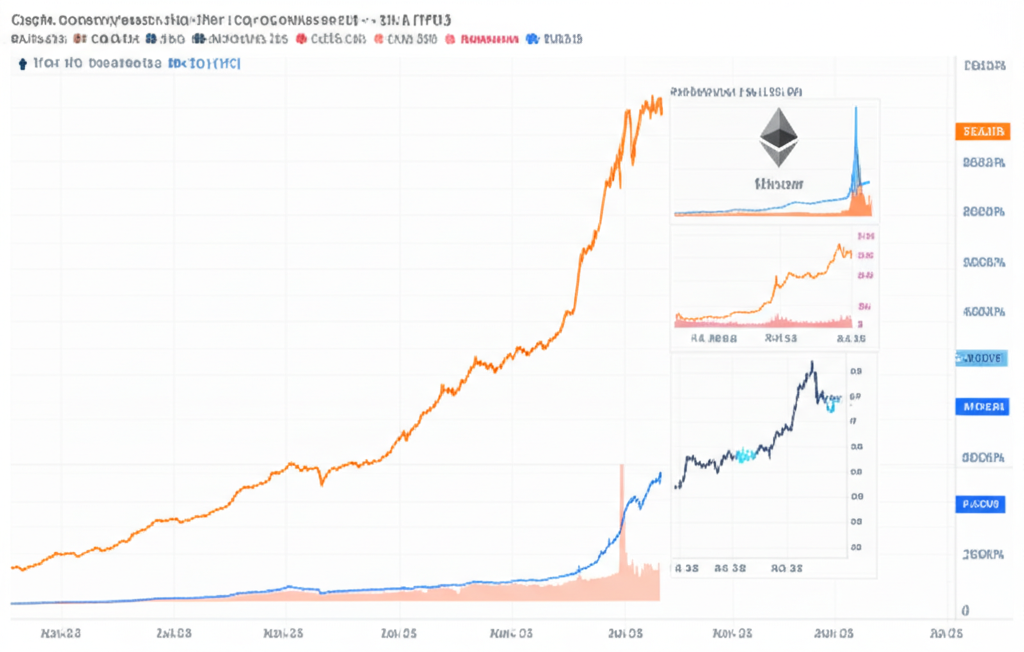

The cryptocurrency market is experiencing a significant surge, with its total market capitalization nearing the staggering $4 trillion mark. This remarkable growth puts the combined value of all cryptocurrencies just behind Apple, the world’s most valuable company, highlighting the increasing influence and maturation of the digital asset space. Recent price rallies in major cryptocurrencies like Ether (ETH) and XRP have been the primary drivers of this impressive climb.

The Rise of ETH and XRP Fuel Market Growth

Ether, the native cryptocurrency of the Ethereum blockchain, has seen a substantial price increase in recent weeks, largely attributed to increased activity within the DeFi (Decentralized Finance) ecosystem and anticipation surrounding Ethereum’s upcoming Shanghai upgrade. This upgrade is expected to unlock staked ETH, potentially increasing liquidity and market pressure. Simultaneously, XRP, the native token of Ripple Labs, has also experienced a significant rally, fueled by positive developments in its ongoing legal battle with the Securities and Exchange Commission (SEC). A positive ruling in this case could have a profound and positive impact on XRP’s price and the broader crypto market.

Analyzing the Market’s Trajectory

While reaching nearly $4 trillion represents a monumental achievement for the crypto market, it’s crucial to understand the volatility inherent in this asset class. Historical data shows periods of both explosive growth and significant corrections. While the current upward trend is encouraging, investors should exercise caution and maintain a diversified portfolio. Regulatory uncertainty remains a key factor influencing market sentiment. Recent legislative efforts in various jurisdictions, including the ongoing debate surrounding crypto regulation in the US, could significantly impact the trajectory of the market. These factors, along with macroeconomic conditions, will continue to shape the crypto landscape.

To put this growth in perspective, let’s consider that back in 2017, the total crypto market cap peaked at around $800 billion during the initial ICO boom. The current near-$4 trillion figure represents a significant five-fold increase, demonstrating the remarkable growth and sustained interest in the space despite market cycles and regulatory challenges. However, several factors could potentially impact this upward trend, including increased regulatory scrutiny, macroeconomic instability, and potential security breaches within the crypto ecosystem.

What’s Next for the Crypto Market?

The near-term future of the crypto market remains uncertain, but several factors will likely play a significant role in determining its trajectory. These include the continued development and adoption of decentralized technologies, the outcome of ongoing legal battles surrounding prominent cryptocurrencies, and the evolving regulatory landscape. The successful integration of cryptocurrencies into mainstream finance and the development of innovative applications will also be crucial in driving continued growth.

- Key Takeaways:

- Crypto market cap is nearing $4 trillion, rivaling Apple’s market cap.

- ETH and XRP price increases are primary drivers of this growth.

- Regulatory uncertainty and macroeconomic factors remain influential.

- Volatility remains a key characteristic of the crypto market.

- Future growth hinges on technological advancements, regulatory clarity, and broader adoption.