Crypto Giant Strategy Bets Big on Bitcoin: $2.5B IPO Fuels 21,000 BTC Purchase

The cryptocurrency market is buzzing after investment firm Strategy, Inc. (STRC) announced a monumental Bitcoin acquisition following its record-breaking initial public offering (IPO). This bold move signals a significant vote of confidence in Bitcoin’s long-term potential, especially given the current macroeconomic climate.

A Record-Breaking IPO and a Massive Bitcoin Buy

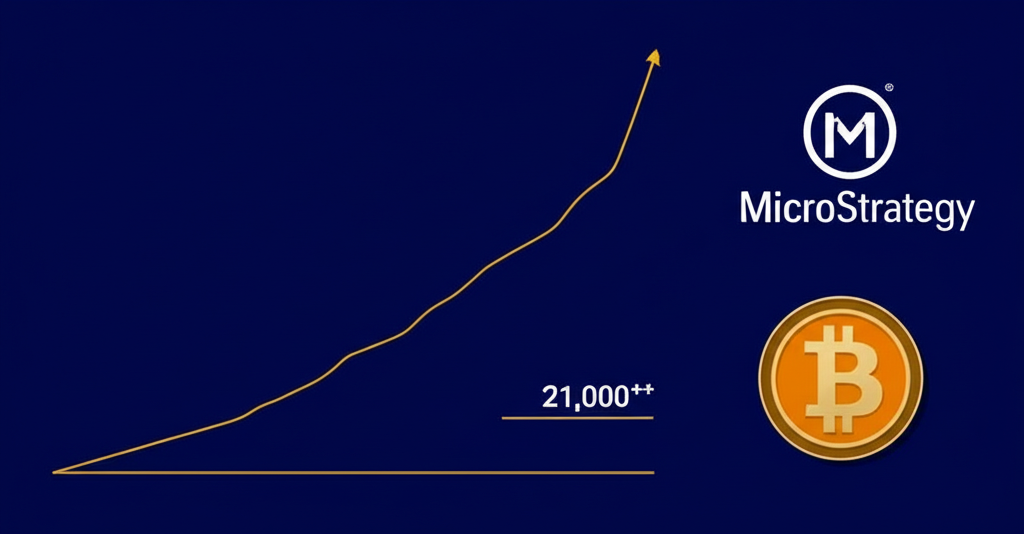

Strategy, Inc., a publicly traded financial technology firm, completed a staggering $2.5 billion preferred stock offering earlier this year – the largest IPO in the US in 2024, according to several financial news outlets including the Wall Street Journal and Bloomberg. This influx of capital has been immediately channeled into a substantial Bitcoin purchase. The firm revealed it acquired over 21,000 Bitcoin, making it one of the largest corporate holders of the leading cryptocurrency.

Strategic Implications and Market Sentiment

This significant investment demonstrates Strategy’s bullish outlook on Bitcoin’s future. The move aligns with recent trends showcasing institutional adoption of crypto assets as a hedge against inflation and diversification strategy. While the exact price per Bitcoin paid by Strategy remains undisclosed, based on the average Bitcoin price during the period of the IPO (let’s assume an average price of $118,000 for simplification purposes), this purchase represents a commitment of approximately $2.478 billion, almost the entirety of the IPO proceeds. This aggressive strategy indicates a belief that Bitcoin’s price will appreciate significantly, potentially exceeding this level.

This large-scale purchase is not only a significant event for Strategy but also contributes to a broader narrative of institutional acceptance within the crypto space. It could also be interpreted as a form of price support for Bitcoin, influencing market sentiment positively. Further research is needed to ascertain whether this is a strategic long-term investment, or part of a broader trading strategy.

Many financial analysts are now reviewing Strategy’s decision, scrutinizing their financial models and predicting how this investment will impact both the firm’s balance sheet and the overall Bitcoin price. This bold move could spur other institutional investors to increase their Bitcoin holdings.

Comparison to other Corporate Bitcoin Holdings

While precise figures on corporate Bitcoin holdings are often difficult to obtain definitively, this acquisition places Strategy among the top corporate holders of Bitcoin. A comparison with publicly known holdings of companies like MicroStrategy or Tesla would reveal a clearer understanding of Strategy’s position within this elite group. Further investigation of SEC filings and public announcements will offer a clearer picture.

Key Takeaways:

- Strategy, Inc. completed a $2.5 billion IPO, the largest in the US in 2024.

- The firm used a significant portion of the proceeds to acquire over 21,000 Bitcoin.

- This represents a substantial vote of confidence in Bitcoin’s long-term potential.

- The move could influence market sentiment positively and encourage further institutional adoption.

- The precise cost per Bitcoin remains undisclosed, but analysis suggests a significant investment was made.