BitMine’s $2B ETH Acquisition: Fueling the Crypto Treasury Arms Race

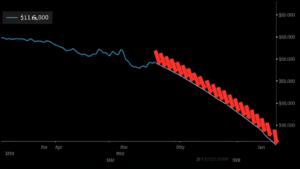

The cryptocurrency market is witnessing a dramatic escalation in the “treasury arms race,” with mining companies aggressively accumulating large reserves of digital assets. This strategic move aims to enhance financial stability and influence within the crypto ecosystem. A recent surge in activity by BitMine, a prominent player in the space, highlights this trend. In just 16 days, BitMine gobbled up over $2 billion worth of Ether (ETH), sparking intense debate and speculation about the future of crypto treasuries.

BitMine’s Aggressive ETH Accumulation Strategy

BitMine’s audacious move underscores a broader trend among crypto mining companies. Instead of solely focusing on mining and selling their newly-mined crypto, they are now actively acquiring and staking large quantities of established cryptocurrencies like ETH. This strategy serves several purposes:

- Financial Security: Holding significant reserves of ETH provides a buffer against market volatility and helps ensure the company’s long-term financial health.

- Influence and Power: Massive ETH holdings grant considerable voting rights within the Ethereum ecosystem, influencing future network development and upgrades.

- Yield Generation: Staking ETH allows BitMine to earn passive income through participation in the Ethereum network’s proof-of-stake consensus mechanism.

Tom Lee, Chairman of BitMine’s board of directors, publicly stated their ambition to accumulate at least 5% of the total Ether supply, a staggering amount exceeding 6 million ETH at current prices (assuming a total supply of around 120 million ETH). This bold declaration has sent ripples through the crypto market, raising questions about potential market manipulation and the long-term implications for ETH’s price stability.

The Implications of BitMine’s Actions

BitMine’s rapid accumulation raises concerns about potential market manipulation and its impact on ETH’s price. While the company may be acting purely for financial stability, the sheer scale of the acquisition could influence price movements. Further, other companies might feel pressured to follow suit, intensifying the arms race and potentially creating an unstable market dynamic. Regulatory scrutiny into these massive treasury acquisitions is also a likely consequence.

Many market analysts are now examining whether this strategy is sustainable in the long term and what kind of impact it could have on decentralization. The increasing concentration of ETH in the hands of a few entities could potentially raise concerns about the long-term security and decentralization of the Ethereum network.

The Broader Crypto Treasury Arms Race

BitMine’s actions are just one example of the ongoing treasury arms race in the cryptocurrency world. Other major players in the mining and crypto industries are likely to follow suit, leading to a further concentration of assets in the hands of a few. This could reshape the landscape of the cryptocurrency market, creating new power dynamics and potential challenges to decentralization.

In Summary:

- BitMine acquired over $2 billion worth of ETH in just 16 days.

- This acquisition is part of a larger trend of cryptocurrency companies accumulating large treasury reserves.

- The move is aimed at enhancing financial stability, gaining influence, and generating passive income through staking.

- Concerns about market manipulation and the impact on ETH’s price and decentralization have been raised.

- The event highlights the intensifying “treasury arms race” in the cryptocurrency industry.