Bitfarms Bets Big on Itself: $49.9M Share Buyback Signals Undervaluation

Bitfarms, a prominent player in the Bitcoin mining industry, is making a bold move, signaling its confidence in its future prospects. The company announced a significant stock buyback program, planning to repurchase up to 49.9 million shares – representing approximately 10% of its outstanding shares – over the next 12 months. This action follows the company’s recent pivot towards high-performance computing (HPC) and artificial intelligence (AI) infrastructure, a strategic shift aiming to diversify its revenue streams beyond Bitcoin mining.

A Vote of Confidence in a Shifting Market

This substantial buyback initiative is a clear indication that Bitfarms’ leadership believes its stock is currently undervalued in the market. The cryptocurrency market has experienced significant volatility in recent times, impacting the valuations of mining companies like Bitfarms. By repurchasing its own shares, Bitfarms effectively reduces the number of outstanding shares, potentially boosting the earnings per share (EPS) and increasing the value of the remaining shares for existing investors.

This move comes at a time when many Bitcoin mining firms are grappling with reduced profitability due to fluctuating Bitcoin prices and increasing energy costs. The fact that Bitfarms is committing to such a substantial buyback suggests a strong belief in its long-term viability and potential for growth, even amidst challenging market conditions. Several analysts have recently suggested that the current market may not accurately reflect the value of Bitcoin mining firms, particularly those with diverse infrastructure like Bitfarms.

High-Performance Computing: A Diversification Strategy

The decision to expand into HPC and AI is a key factor driving Bitfarms’ confidence. While Bitcoin mining remains a core component of its business, the company recognizes the potential for significant revenue generation from providing high-performance computing resources to other industries. This diversification strategy could mitigate the risks associated with relying solely on the volatile cryptocurrency market. The vast computing power required for Bitcoin mining can be readily repurposed for HPC tasks, offering a potential revenue stream independent of Bitcoin’s price fluctuations.

This strategic diversification, coupled with the aggressive share buyback, paints a picture of a company actively managing risk and positioning itself for growth in the evolving technological landscape. While the full impact of this strategy remains to be seen, it suggests Bitfarms is anticipating a surge in demand for HPC resources in the coming years. The increasing adoption of AI across various sectors is likely a significant driver behind this optimistic outlook.

Market Reaction and Future Outlook

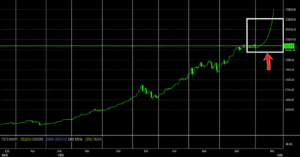

The market’s reaction to the news will be closely watched. A positive response could signal investor confidence in Bitfarms’ strategic vision and its ability to navigate the complexities of the cryptocurrency and technology sectors. Conversely, a negative or muted response may indicate lingering concerns about the overall market conditions and the risks associated with Bitcoin mining. This buyback program represents a significant financial commitment by Bitfarms, and its success will depend on several factors, including the future performance of Bitcoin, the growth of the HPC market, and the general state of the global economy.

Summary:

- Bitfarms announced a $49.9M share buyback program (approx. 10% of outstanding shares).

- The buyback signals Bitfarms believes its stock is undervalued.

- The company is pivoting towards high-performance computing and AI infrastructure, diversifying its revenue streams.

- This strategic move aims to mitigate risks associated with Bitcoin price volatility.

- Market reaction to the announcement will be crucial in determining the long-term success of this strategy.