Bitcoin’s Social Dominance Soars: Is This the Dip to Buy?

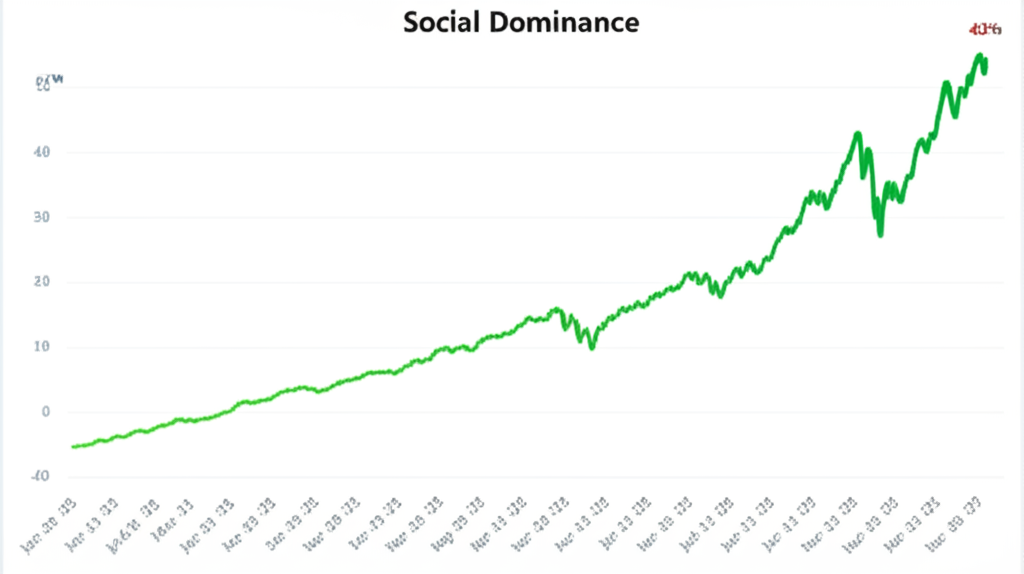

Bitcoin’s price action has been volatile recently, leaving many investors wondering whether now is the time to buy. A new analysis from on-chain data provider Santiment suggests a compelling case for precisely that. Their data reveals Bitcoin’s social dominance has surged to a remarkable 43%, hinting at a potential “key entry point” for shrewd investors.

Santiment’s Social Dominance Metric: A Predictive Indicator?

Santiment’s metric, “social dominance,” measures the proportion of cryptocurrency-related social media chatter dedicated to Bitcoin relative to all other cryptocurrencies. A high percentage suggests significant public interest and potential for price appreciation. While correlation doesn’t equal causation, historical data suggests a strong relationship between spikes in Bitcoin’s social dominance and subsequent price increases. This isn’t necessarily a foolproof prediction, but it provides a valuable data point for informed investment decisions.

Unpacking the 43% Spike

The 43% social dominance figure represents a substantial increase compared to recent levels and signifies a significant shift in the conversation surrounding cryptocurrencies. This surge in Bitcoin-centric discussions suggests a resurgence of investor interest and a potential shift away from alternative crypto assets. Previous similar spikes have often preceded periods of price recovery or upward momentum for Bitcoin.

Interpreting the Signal: Cautious Optimism

While the 43% social dominance spike is bullish, investors should remain cautious. It’s crucial to consider other macroeconomic factors, such as regulatory uncertainty and overall market sentiment, before making any investment decisions. This data point shouldn’t be interpreted in isolation. A comprehensive analysis incorporating technical indicators, fundamental analysis, and risk management strategies is vital.

Beyond Social Media Buzz: What Else to Consider?

It’s important to look at the broader picture. Along with Santiment’s findings, investors should analyze:

- On-chain metrics: Factors like transaction volume, mining difficulty, and network hash rate can provide further insight into Bitcoin’s underlying health.

- Macroeconomic factors: Inflation rates, interest rates, and global economic stability significantly influence crypto market performance.

- Regulatory news: Announcements related to crypto regulation can significantly impact prices.

Conclusion: A Potential Buying Opportunity, But Proceed with Caution

The recent spike in Bitcoin’s social dominance to 43%, as highlighted by Santiment, suggests a potential buying opportunity. However, investors should treat this as one data point among many. A thorough risk assessment and consideration of other market factors are essential before committing capital. This surge in online chatter might indicate a renewed interest in Bitcoin, but the market’s direction is far from guaranteed.

Key Takeaways:

- Bitcoin’s social dominance reached 43%, a historically significant level.

- Santiment suggests this could be a “key entry point” for Bitcoin.

- Investors should consider this data alongside other on-chain and macroeconomic factors.

- A holistic approach is vital to making informed investment decisions.