Bitcoin’s Next Bull Run: 2026? Bitwise CIO Declares Four-Year Cycle “Dead”

The cryptocurrency market is buzzing with speculation about Bitcoin’s future price trajectory. While many cling to the historical four-year cycle theory, predicting a bull run in 2025, a prominent voice in the industry is challenging this established narrative. Bitwise Asset Management’s CIO recently declared that 2026 is the more likely candidate for Bitcoin’s next significant price surge, effectively suggesting the death of the widely accepted four-year cycle.

The Demise of the Four-Year Cycle?

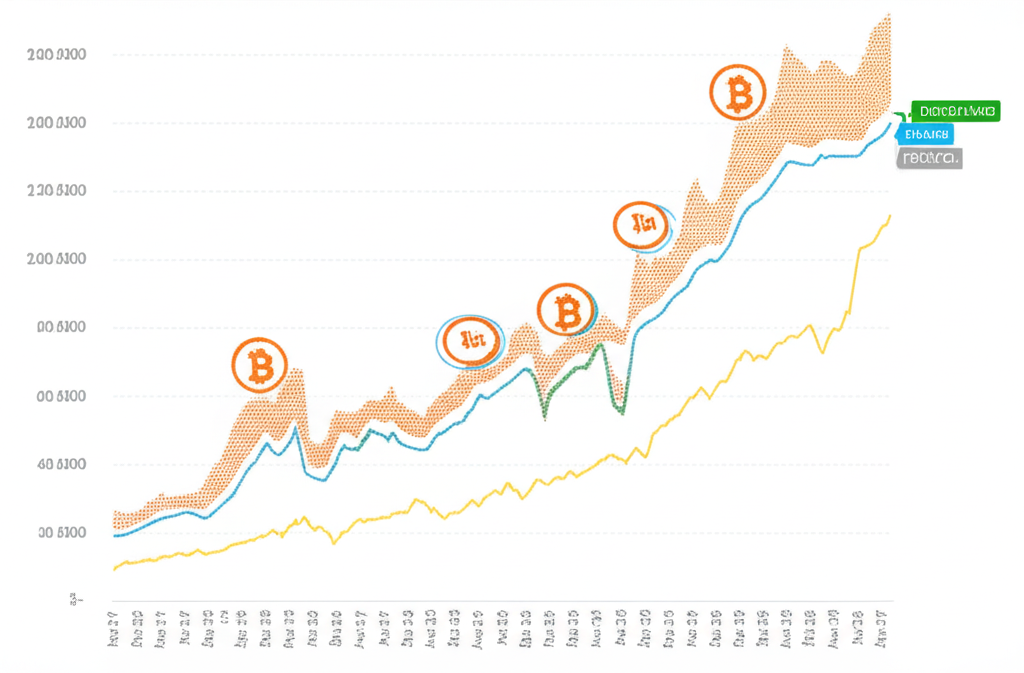

The cryptocurrency community has long observed a pattern of Bitcoin price cycles, roughly peaking every four years following halving events – where the rate of newly mined Bitcoin is cut in half. This pattern has fueled predictions for a 2025 bull run, coinciding with the next Bitcoin halving scheduled for spring 2024. However, Bitwise’s CIO, in an interview with Cointelegraph, casts doubt on this established theory. He acknowledges the possibility of being wrong but expresses a strong belief that 2026 represents a more accurate timeframe for the next major Bitcoin upside.

Macroeconomic Factors and Regulatory Uncertainty

Several factors contribute to this revised prediction. The current macroeconomic environment, characterized by persistent inflation and tightening monetary policies, is impacting investor sentiment and asset allocation strategies. Furthermore, regulatory uncertainty, particularly regarding cryptocurrency oversight in major markets like the US, continues to introduce volatility and unpredictability. These factors, according to Bitwise’s CIO, may delay the typical four-year cycle’s effect, pushing the next bull market further into the future.

Beyond the Halving: Other Influencing Factors

While the Bitcoin halving remains a significant event influencing supply and demand, it’s not the only factor at play. Recent developments like the growing adoption of Bitcoin by institutional investors, the ongoing innovation in the Bitcoin ecosystem (e.g., Lightning Network advancements), and the increasing regulatory clarity (or lack thereof) all contribute to a more complex picture than a simple four-year cycle can encompass. Bitwise’s perspective highlights the increasing interconnectedness of Bitcoin’s price with broader macroeconomic and regulatory landscapes.

What to Expect in the Next Few Years?

The prediction of a 2026 bull run does not preclude significant price fluctuations in the interim. We could see periods of sideways trading, minor bull runs, or even short-term bearish trends before the larger upward trend materializes. Investors should approach the market with caution, focusing on long-term strategies and risk management.

Key Takeaways:

- Bitwise Asset Management’s CIO predicts a Bitcoin price surge in 2026, not 2025.

- This prediction challenges the established four-year cycle theory.

- Macroeconomic factors and regulatory uncertainty are influencing the timing of the next bull market.

- The Bitcoin halving remains important but isn’t the sole determinant of price movements.

- Investors should adopt a long-term perspective and manage risk effectively.