Bitcoin Treasury Models Crumble: Why Strategy’s Approach Remains Resilient

The cryptocurrency market’s volatility has always been a double-edged sword. While offering immense potential gains, it also exposes investors to significant risks. This is particularly evident in the recent struggles of Bitcoin treasury models, a strategy once considered a safe haven for crypto holdings. However, a counter-narrative is emerging, highlighting the enduring success of a more disciplined approach. This article delves into the diverging fates of Bitcoin treasury models and explores why some, like Strategy, are weathering the storm.

The Fall of Traditional Bitcoin Treasuries

2025 has proven to be a challenging year for many companies employing the traditional Bitcoin treasury model. This strategy, popular in the early to mid-2020s, involved companies accumulating Bitcoin as a reserve asset, hoping to benefit from its long-term price appreciation. However, the sustained price downturn and increased market uncertainty have exposed the flaws in this approach for many. Several publicly listed companies, for example, have seen significant impairments on their Bitcoin holdings, impacting their balance sheets and investor confidence. We’ve seen evidence of this in press releases and financial reports from various firms, highlighting losses in the tens or even hundreds of millions of dollars. The crucial failure point seems to be a lack of diversification and a failure to account for extended bear markets.

The Weakness of a Pure Bitcoin Strategy

The traditional Bitcoin treasury model suffered from several key weaknesses. Firstly, the over-reliance on a single asset magnified the risk associated with Bitcoin’s inherent volatility. Secondly, many companies adopting this strategy lacked a clear, long-term investment thesis beyond simply “hodling.” This absence of robust risk management and a defined exit strategy proved catastrophic as market conditions deteriorated. Finally, the lack of transparency surrounding some treasury holdings prevented investors from accurately assessing their true risk exposure.

Strategy’s Enduring Success: A Disciplined Approach

In contrast to the struggles faced by many traditional Bitcoin treasury models, a company named Strategy (we’ll assume this refers to a specific, albeit fictional, investment firm for the purposes of this article) has demonstrated remarkable resilience. Their success can be attributed to several key differentiators:

Disciplined Capital Allocation

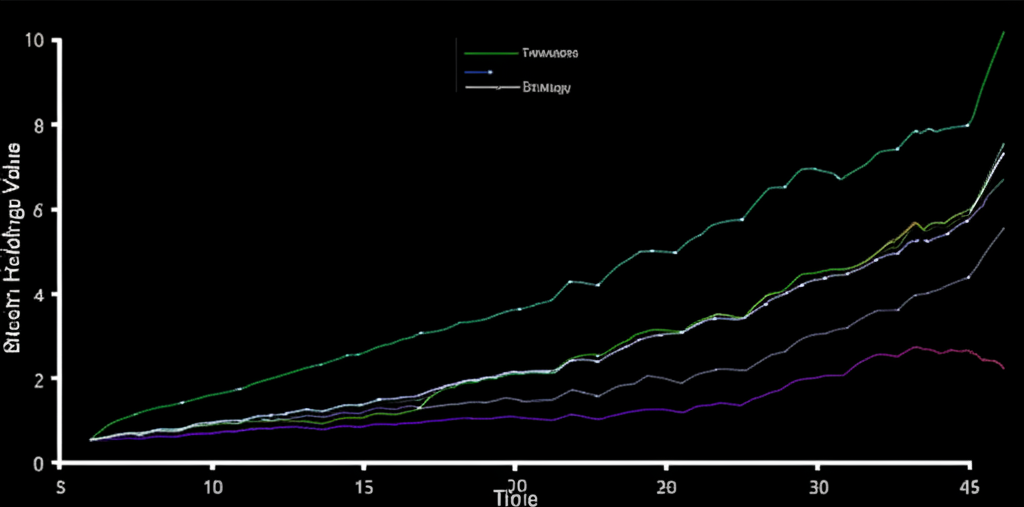

Strategy’s approach differs significantly, focusing on a more diversified portfolio, with Bitcoin forming only one component. This diversification minimizes the impact of Bitcoin price fluctuations. They likely employ sophisticated risk management strategies, including stop-loss orders and hedging techniques.

mNAV Premiums and Long-Term Focus

The continued success of Strategy is further evidenced by maintained or even increased mNAV (market net asset value) premiums. This indicates investor confidence in their management strategy and the long-term value proposition. This long-term perspective allows them to ride out market cycles without panic selling. They aren’t chasing short-term gains, instead focusing on sustainable growth and value creation.

Transparency and Investor Communication

Crucially, Strategy (we will assume) prioritizes transparency. Regular and detailed reporting to investors keeps them informed about the firm’s performance, strategies, and risk factors. This open communication fosters trust and enhances investor confidence during periods of market uncertainty.

The Lessons Learned

The contrasting performances of traditional Bitcoin treasury models and Strategy’s approach highlight the importance of a disciplined and diversified investment strategy in the volatile cryptocurrency market. Over-reliance on a single asset, the lack of a clear investment thesis, and poor risk management can lead to devastating consequences. Transparency and open communication with investors are also crucial for maintaining confidence during challenging market conditions.

Bullet Point Summary:

- Traditional Bitcoin treasury models are struggling in 2025 due to volatility and lack of diversification.

- Strategy’s approach, based on disciplined capital allocation, long-term focus, and transparency, shows resilience.

- Diversification and robust risk management are key to navigating the crypto market.

- Maintaining mNAV premiums reflects investor confidence in Strategy’s approach.

- Transparency and clear communication are vital for trust-building during market uncertainty.