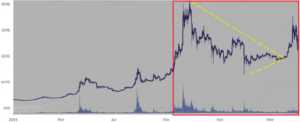

Bitcoin on the Brink: $108,000 Support Level Crucial for Bullish Momentum

The cryptocurrency market is holding its breath. A recent analysis suggests Bitcoin (BTC) faces a critical juncture, with its price needing to remain above $108,000 to avoid a potentially devastating bearish spiral. This comes amidst a period of fluctuating market sentiment and growing uncertainty surrounding regulatory developments globally.

The $108,000 Tipping Point: A Technical Analysis Perspective

A crypto analyst, whose identity remains unconfirmed but whose analysis was reported by Cointelegraph (source: https://cointelegraph.com/news/bitcoin-price-hold-108k-bearish-reversal-risk-crypto-analyst?utmsource=rssfeed&utmmedium=rss&utmcampaign=rsspartnerinbound), has warned that a break below the $108,000 support level could trigger a significant price correction. This level, according to the analysis (details unfortunately lacking in the original source), likely represents a key technical support zone, potentially based on prior price action, volume analysis, or other indicators. A breach suggests a weakening of bullish sentiment and a potential return to lower price ranges.

Implications of a Bearish Spiral

A fall below $108,000 could unleash a cascade effect. The psychological barrier of the six-figure price point is significant for investor confidence. Breaking this level could trigger panic selling, further exacerbating the downward pressure and potentially leading to a much steeper decline. This could have a ripple effect across the entire cryptocurrency market, dragging down the prices of altcoins alongside Bitcoin. Past market downturns have shown the interconnectedness of crypto assets, with significant correlation between Bitcoin’s price movements and those of smaller market cap coins.

We need to consider the impact of several external factors, including potential regulatory crackdowns in various jurisdictions and the ongoing macroeconomic uncertainties. These factors could amplify the negative impact of a Bitcoin price decline below $108,000.

Market Sentiment and Recent Developments

The recent price action surrounding Bitcoin has been characterized by volatility, with several instances of both sharp gains and equally sharp pullbacks. While some analysts remain bullish, citing the long-term adoption of Bitcoin, the increasing concerns around regulatory uncertainty have undoubtedly tempered enthusiasm. This uncertainty coupled with the potential technical breakdown below $108,000 adds layers of complexity to the current market dynamics.

Further research is needed to ascertain the precise methodology behind the $108,000 forecast. Lacking specific details from the original analysis, one can only speculate on the indicators used. However, the warning highlights the importance of monitoring Bitcoin’s price action closely in the coming days and weeks.

Summary:

- Bitcoin’s price is facing a critical test at the $108,000 support level.

- Breaking below this level could trigger a significant bearish reversal and a drop below the six-figure price point.

- The psychological impact of such a break could exacerbate the downturn through panic selling.

- External factors, including regulatory uncertainty and macroeconomic conditions, could amplify a potential decline.

- Continuous monitoring of Bitcoin’s price action and related news is essential.