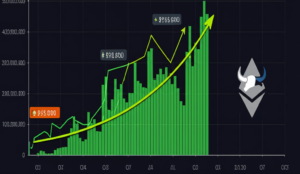

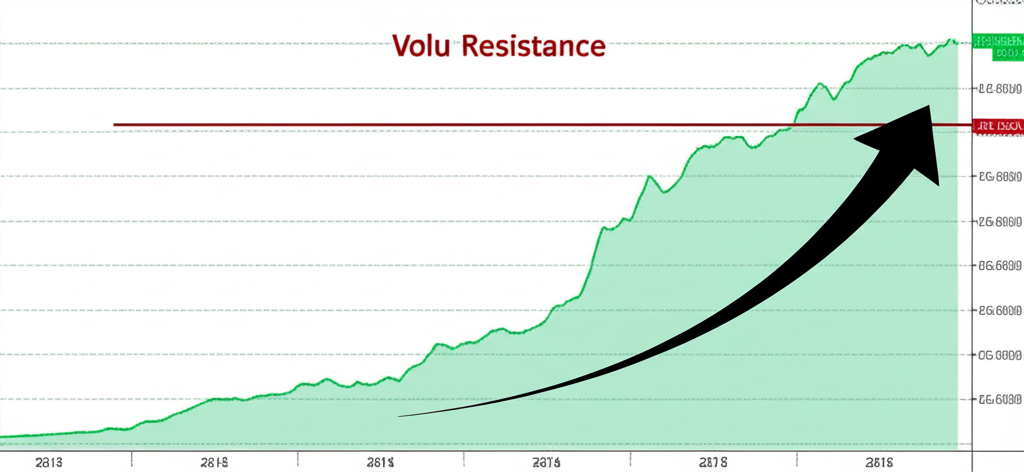

Bitcoin Needs Volume Surge to Break $120,000 Resistance, Analysts Say

Bitcoin (BTC) has been consolidating for months, leaving many investors wondering when the next bull run will begin. Recent analysis suggests that a significant increase in trading volume is the key to unlocking further price appreciation and pushing BTC beyond the crucial $120,000 resistance level. This follows several months of relatively muted trading activity amidst macroeconomic uncertainty and regulatory scrutiny.

The Volume Conundrum: Why Trading Activity is Crucial

According to multiple sources, including a recent report from Cointelegraph citing unnamed analysts, the current lack of robust trading volume is preventing Bitcoin from breaking through significant resistance points. While the price has shown signs of strength at various times, these rallies have lacked the sustained upward momentum needed to overcome the psychological barrier of $120,000. This resistance level represents a significant hurdle, having acted as a ceiling on previous attempts to reach new all-time highs. Without a significant increase in buying pressure, manifested through increased trading volume, the chances of breaching this level remain low.

Macroeconomic Factors at Play

The subdued trading volume is likely influenced by several factors, including ongoing inflation concerns, rising interest rates, and the general uncertainty in the global economy. These macroeconomic headwinds have dampened investor risk appetite across various asset classes, including cryptocurrencies. News of potential regulatory changes in different jurisdictions also contributes to the cautious market sentiment, preventing large institutional investors from fully committing to Bitcoin.

Furthermore, the recent collapse of several prominent cryptocurrency exchanges and lending platforms has shaken investor confidence, leading to a period of consolidation and risk aversion. This has understandably limited the inflow of fresh capital into the market, contributing to the low trading volume.

The Path to $120,000 and Beyond: A Bullish Scenario

For Bitcoin to reach new all-time highs and move beyond the $120,000 mark, analysts predict that a significant surge in trading volume is absolutely necessary. This volume increase would need to be sustained over a considerable period, signaling a renewed belief in Bitcoin’s long-term potential. Such a surge could be triggered by a confluence of factors, including positive regulatory developments, improved macroeconomic conditions, and a renewed interest from institutional investors. Several analysts have suggested that a volume increase of at least 30%–50% above the recent average would be needed to overcome the existing resistance.

However, it’s crucial to remember that this is not a guaranteed prediction. The cryptocurrency market remains highly volatile, and unpredictable events can drastically impact price movements.

Conclusion: Waiting for the Volume Breakout

The current state of the Bitcoin market highlights the importance of trading volume in determining price direction. While technical analysis suggests potential upside, the lack of significant volume presents a clear obstacle to reaching new all-time highs. A sustained increase in trading volume, coupled with positive external factors, is crucial for Bitcoin to break the $120,000 resistance level and re-enter a phase of price discovery.

Summary:

- Bitcoin needs significantly higher trading volumes to break through the $120,000 resistance.

- Current low volume is attributed to macroeconomic uncertainty and regulatory concerns.

- A substantial volume increase is necessary to sustain upward momentum.

- Reaching new highs depends on a combination of increased volume and positive external factors.

- The cryptocurrency market remains volatile, and predictions are not guaranteed.