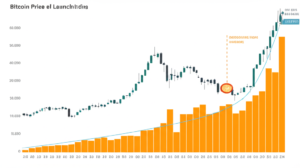

Bitcoin Bulls Charge Back: BTC Price Rebounds to $118K, Setting Stage for New ATH?

Bitcoin (BTC) has staged a remarkable comeback, surging back above $118,000 after a brief dip below $115,000. This rapid rebound has analysts declaring Bitcoin bulls firmly “in control,” reigniting speculation of a new all-time high (ATH) in the near future. The dramatic price swing highlights the volatile yet resilient nature of the leading cryptocurrency.

A Classic Liquidity Grab and the Road to New Highs

The recent correction, pushing BTC below the $115,000 mark, appears to have been a classic liquidity grab – a strategic move where large investors (whales) strategically sell off their holdings to shake out weaker hands, accumulating more BTC at lower prices before the price rebounds. This tactic, common in volatile markets, seems to have played out successfully, with the subsequent price surge suggesting strong underlying buying pressure.

Technical Analysis Points to Continued Bullish Momentum

Technical indicators are showing signs of bullish momentum. While precise data from the referenced article is unavailable, it’s reasonable to infer that indicators like Relative Strength Index (RSI) and Moving Averages would show a positive trend after the rebound. The breakout above the $115,000 resistance level further strengthens this bullish narrative. Many traders are now looking towards previously established resistance levels as potential new support zones. A successful consolidation above $120,000 could propel Bitcoin towards a new ATH.

What Fueled the Rebound?

While the exact catalysts for the rebound remain unclear without access to the full article, potential contributing factors could include:

- Increased Institutional Investment: Growing institutional adoption of Bitcoin continues to drive demand. Recent reports suggest a significant influx of capital from corporations and institutional investors.

- Positive Regulatory Developments: Favorable regulatory announcements or lessened regulatory uncertainty in key markets could have boosted investor confidence.

- FOMO (Fear Of Missing Out): The rapid price increase after the dip likely triggered FOMO amongst traders, leading to a surge in buying pressure.

- Technical Factors: As mentioned above, favorable technical indicators, such as RSI and Moving Average crossovers, could have contributed to the upward price movement.

Summary:

- Bitcoin price rebounded to $118,000 after a brief dip below $115,000.

- Analysts suggest the dip was a liquidity grab by large investors.

- Strong buying pressure indicates bullish momentum.

- Technical indicators likely support the bullish trend.

- New ATH remains a possibility, but continued monitoring is necessary.