Bitcoin Bulls Charge: $1B in Crypto Shorts Liquidated as BTC Pumps

The cryptocurrency market experienced a dramatic shift in the last 24 hours, leaving many short sellers reeling. A significant Bitcoin price surge triggered a massive liquidation event, wiping out over $1 billion in short positions and highlighting the sudden volatility in the crypto space. This unexpected rally has sent shockwaves through the market, leaving analysts scrambling to understand the driving forces behind this dramatic turnaround.

A Billion-Dollar Wipeout: The Liquidation Event

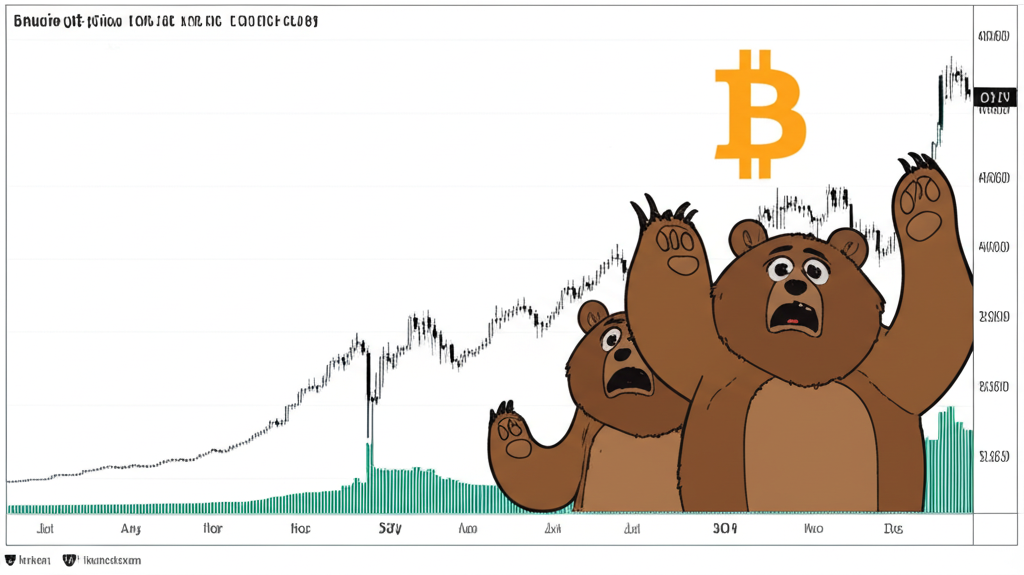

Data from Cointelegraph and other market tracking websites shows that approximately 232,149 traders were liquidated in the past 24 hours. The sheer scale of this liquidation event, exceeding $1 billion, underscores the significant bet many traders had placed against Bitcoin’s upward trajectory. This suggests a substantial level of bearish sentiment preceding the recent price pump. The sudden reversal caught many off guard, leading to significant losses for those who had bet on a continued price decline. While the exact reasons for the surge remain a subject of ongoing debate, several factors likely contributed to the market’s rapid shift.

Potential Catalysts Behind the Bitcoin Rally

Several factors may have contributed to this sudden Bitcoin price surge and the subsequent liquidation of short positions. These include:

-

Positive Regulatory Developments: Recent positive news or statements from regulatory bodies around the world, particularly concerning the acceptance or regulation of cryptocurrencies, could have injected a wave of confidence into the market. This could have encouraged institutional investors to increase their holdings, driving up demand and price. For example, potential clarity on US regulatory frameworks could have greatly influenced the market.

-

Macroeconomic Factors: Changes in traditional financial markets, such as shifts in interest rates or inflation expectations, can often impact the cryptocurrency market. A sudden shift in investor sentiment towards riskier assets, including Bitcoin, could have triggered the rally.

-

Increased Institutional Adoption: The continued adoption of Bitcoin by larger institutional investors may also play a significant role. Gradual increases in institutional investment can lead to more stable price increases, but large, sudden inflows can contribute to dramatic market movements like the recent surge.

- Technical Factors: Technical analysis, focusing on charts and trading patterns, often plays a crucial role in shaping market sentiment. A breakout above a key resistance level, for example, could have triggered a wave of buy orders, exacerbating the price increase.

The lack of a singular, clearly defined trigger highlights the complex interplay of factors affecting the crypto market’s volatility.

Bears in Disbelief: Market Sentiment Shifts

The sheer scale of the liquidations has left many market analysts surprised. The phrase “bears in disbelief” perfectly captures the sentiment among those who had bet against Bitcoin. This event serves as a stark reminder of the risks associated with shorting volatile assets like Bitcoin. While short selling can be a profitable strategy, it requires careful risk management and a deep understanding of market dynamics. The recent events highlight the potential for significant losses in a rapidly changing market.

Summary:

- Over $1 billion in crypto shorts liquidated in 24 hours.

- Approximately 232,149 traders were liquidated.

- The event followed a significant Bitcoin price surge.

- Multiple factors, including regulatory news, macroeconomic conditions, and institutional adoption, may have contributed to the rally.

- The event underscores the high volatility and risks associated with the crypto market.