Bitcoin Breaks $120K: Volatility Soars, Analysts Predict Wild Ride Ahead

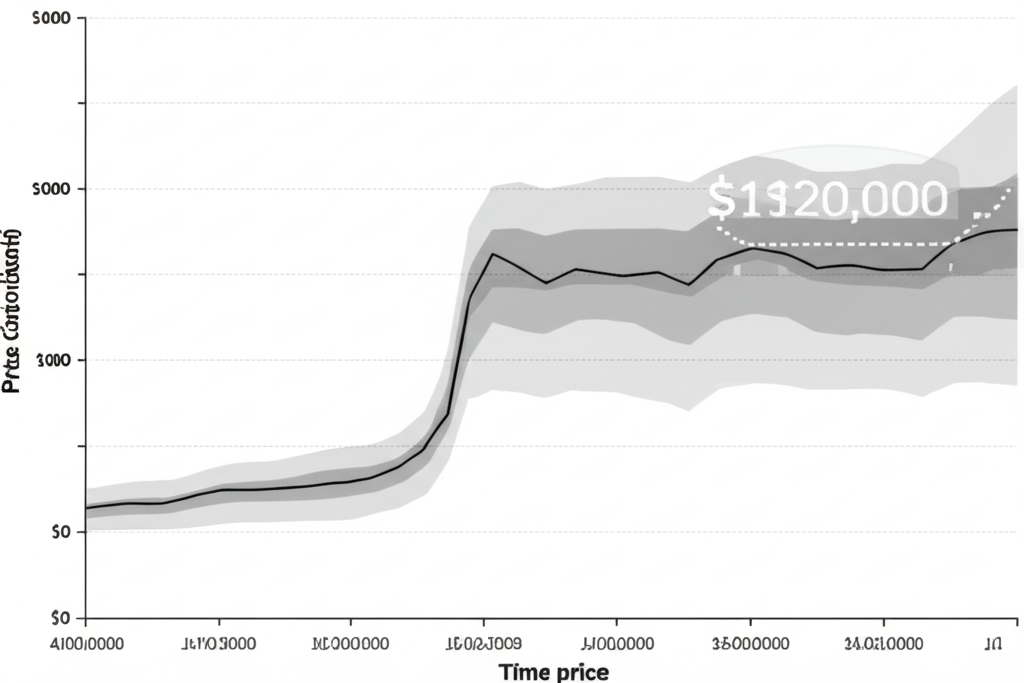

Bitcoin’s price surged dramatically over the weekend, briefly touching the $120,000 mark before experiencing a slight correction. This unexpected volatility has sent shockwaves through the crypto market, prompting analysts to predict even larger price swings in the near future. This rapid ascent, followed by a pullback, highlights the inherent risk and reward associated with Bitcoin investment.

A Weekend of Wild Swings: Bitcoin’s Breakout and Subsequent Dip

The sudden surge in Bitcoin’s price caught many investors off guard. While the exact catalysts remain unclear, several factors likely contributed to the rally. Recent positive news regarding Bitcoin ETFs, coupled with ongoing inflation concerns and potential institutional buying, could have fueled the upward momentum. However, the rapid ascent also triggered significant liquidations in certain key price levels, suggesting a period of instability. The resulting dip, although noteworthy, indicates the market’s immediate reaction to the sudden price increase.

The close above a crucial psychological barrier, previously thought to be strong resistance, suggests a potential shift in market sentiment. However, this doesn’t negate the predictions of increased volatility moving forward.

Liquidation Zones and the Implications for Traders

Reports suggest that substantial liquidations occurred as Bitcoin approached $120,000, indicating a significant number of traders were leveraged long. These events frequently act as catalysts for further price fluctuations. The liquidation of these long positions could have contributed to the subsequent pullback, showcasing the potential for sharp corrections in a market characterized by high leverage. Traders are advised to exercise caution and manage risk effectively in light of these predicted larger price swings.

What Lies Ahead: Analyst Predictions and Market Outlook

Several cryptocurrency analysts have commented on the current market situation, predicting a period of increased volatility. The increased price volatility, following the surge to near $120,000 and subsequent correction, supports this prediction. Some analysts suggest that the market is testing the limits of both bull and bear sentiment, creating an environment conducive to larger and more frequent price swings. Others point towards the continued uncertainty surrounding regulatory frameworks as another contributing factor to market instability.

The lack of clear definitive triggers for the recent price spike underscores the difficulty of predicting Bitcoin’s future trajectory. The market remains subject to numerous external influences, including macroeconomic conditions, regulatory developments, and overall investor sentiment.

Summary:

- Bitcoin briefly reached near $120,000 before a slight correction.

- This surge triggered significant liquidations at key price levels.

- Analysts predict even larger price swings are imminent.

- The market remains highly volatile and subject to external influences.

- Traders are urged to monitor the market closely and manage risk effectively.