Animoca Brands Leverages Bitcoin Treasury with DDC Enterprise Partnership: A Smart Strategy?

Animoca Brands, a leading player in the blockchain gaming and metaverse sectors, has announced a partnership with DDC Enterprise to optimize its Bitcoin treasury. This move underscores a broader trend among established companies to actively utilize their Bitcoin holdings, moving beyond simple asset accumulation. The partnership signifies a strategic shift towards generating yield and exploring innovative applications for Bitcoin beyond simply holding it as a store of value.

Animoca’s Bitcoin Strategy: Beyond HODLing

Animoca Brands, known for its investments in numerous NFT projects and metaverse ventures, has long been recognized for its forward-thinking approach to digital assets. While the exact size of its Bitcoin treasury remains undisclosed, this partnership with DDC Enterprise suggests a significant holding that the company aims to actively manage. This strategy contrasts with a simple “HODL” approach, which involves passively holding Bitcoin in anticipation of future price appreciation. Instead, Animoca is clearly seeking ways to generate additional returns and potentially enhance the overall value of its treasury.

DDC Enterprise: The Key Partner

DDC Enterprise, a firm specializing in digital asset management and treasury solutions, will play a critical role in this endeavor. While specifics on the exact nature of the collaboration aren’t fully detailed in the initial announcement, it’s likely to involve strategies such as:

- Yield Generation: Exploring various avenues to generate returns on the Bitcoin holdings, potentially through lending, staking, or other sophisticated financial instruments.

- Risk Management: Implementing strategies to mitigate potential risks associated with Bitcoin’s price volatility.

- Treasury Optimization: Streamlining the management of Animoca’s Bitcoin assets for better efficiency and transparency.

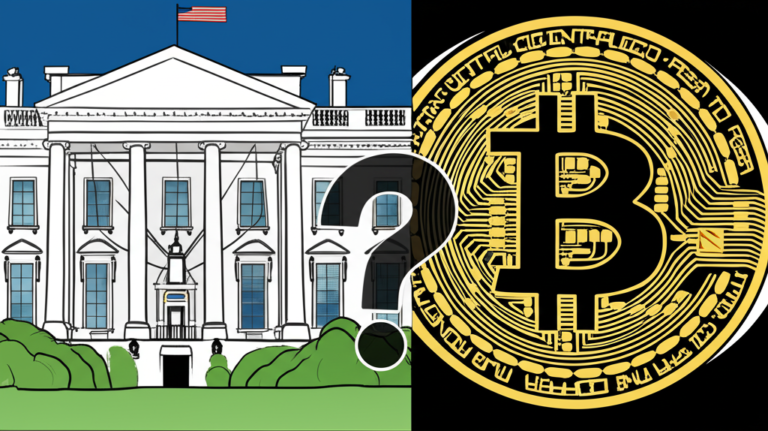

The Growing Trend of Active Bitcoin Treasuries

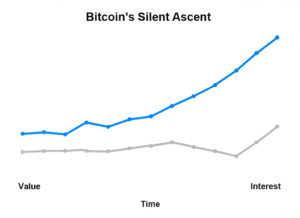

Animoca Brands’ move is part of a wider trend amongst corporations incorporating Bitcoin into their financial strategies. We’ve seen a significant increase in companies adopting Bitcoin as a treasury asset in recent years, with many choosing to actively manage these holdings rather than simply holding them. This highlights a growing confidence in Bitcoin’s long-term potential and a desire to unlock its utility beyond its traditional store-of-value function. Other prominent examples (though specific strategies may differ) include MicroStrategy and Tesla, who have amassed considerable Bitcoin reserves.

Implications and Future Outlook

This partnership between Animoca Brands and DDC Enterprise could have significant implications for the broader cryptocurrency market. It validates the increasing sophistication of corporate treasury strategies involving digital assets. It also indicates a shift towards a more active management of Bitcoin within corporate portfolios, moving beyond a simple “store-of-value” narrative. Further details regarding the specific strategies employed by Animoca and DDC are eagerly anticipated by market analysts. The success of this initiative could inspire other companies to adopt similar approaches, potentially boosting demand for Bitcoin-related services and increasing the adoption of Bitcoin within traditional finance.

Key Takeaways:

- Animoca Brands partners with DDC Enterprise to actively manage its Bitcoin treasury.

- This strategy signifies a move beyond passive “HODLing” towards yield generation and risk management.

- The partnership highlights a growing trend among corporations to actively utilize their Bitcoin holdings.

- The initiative could influence other companies to adopt similar active treasury management strategies for Bitcoin.