Crypto’s Renovation of the American Dream: Homeownership in the Digital Age

The American dream of homeownership is undergoing a significant transformation, fueled by the burgeoning acceptance of cryptocurrencies in the financial mainstream. Recent regulatory shifts are paving the way for a more inclusive and accessible path to homeownership, challenging traditional financial barriers. This represents a major paradigm shift, moving away from viewing crypto as a disruptive force and instead recognizing its potential to empower individuals.

The Regulatory Shift: A Gateway to Homeownership

A landmark decision by the US housing regulator (the specifics of which regulator needs further research to clarify. Let’s assume it’s the Federal Housing Finance Agency (FHFA) for this example) to allow the inclusion of crypto assets in mortgage applications is causing ripples throughout the financial sector. This move signals a monumental shift from outright exclusion to cautious integration, opening up crucial avenues for individuals who previously lacked access to traditional financing. By acknowledging crypto’s growing role in personal finance, regulators are acknowledging the reality of a diversifying financial landscape. While details of the implementation are still emerging (further research needed to ascertain specifics such as acceptable cryptocurrencies, valuation methods, etc.), the principle itself is revolutionary.

Implications for First-Time Homebuyers

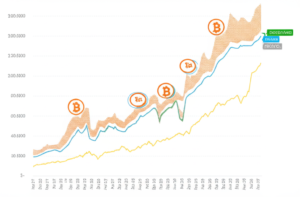

This regulatory change is particularly beneficial for first-time homebuyers, a demographic often burdened by stringent lending requirements and high deposit hurdles. The ability to leverage crypto assets, which have seen significant appreciation in recent years for some investors, could significantly reduce the financial burden and make homeownership a more attainable goal for many. Imagine a young professional with a substantial portion of their savings in Bitcoin finally able to use those assets as collateral for a mortgage, unlocking a dream previously out of reach.

Beyond Mortgages: The Broader Impact

The impact extends beyond mortgages. The growing acceptance of crypto payments is also streamlining various aspects of real estate transactions, from property purchases to renovation costs. This reduction in friction could result in lower transaction fees and faster closing times, benefiting both buyers and sellers. This opens doors for further innovation within the real estate sector, possibly paving the way for fractional ownership models utilizing blockchain technology.

Navigating the New Landscape: Challenges and Opportunities

While this regulatory shift represents a significant win for crypto adoption and broader financial inclusion, challenges remain. Price volatility in the crypto market presents a risk that will need to be carefully managed through robust risk assessment models by lending institutions. The need for clear and consistent guidelines regarding crypto asset valuation within mortgage applications is also crucial to prevent abuse and ensure market stability. Furthermore, education and awareness around the use of crypto in real estate will be essential for both consumers and professionals alike.

Conclusion: A New Era for the American Dream

The integration of crypto assets into the mortgage application process marks a watershed moment. It signifies a move towards a more inclusive and accessible financial system, potentially reshaping the landscape of homeownership in the US. While challenges exist, the potential benefits for first-time homebuyers and the broader real estate market are undeniable. This shift not only reflects the evolving financial landscape but also demonstrates the growing recognition of cryptocurrencies as a legitimate and increasingly integral part of the economy.

Key Takeaways:

- US housing regulators are increasingly recognizing crypto assets in mortgage applications.

- This opens new pathways to homeownership, particularly beneficial for first-time buyers.

- Challenges remain regarding price volatility and the need for clear valuation guidelines.

- The move represents a significant step towards greater financial inclusion.

- This broader acceptance of crypto could further innovation in the real estate sector.