XRP’s Healthy Correction and Ether’s Looming Supply Shock: Market Analysis for July 20-26

The cryptocurrency market experienced a period of both consolidation and potential upheaval during the week of July 20-26, according to Hodler’s Digest. While XRP saw a temporary dip deemed a “healthy correction” by analysts, Ethereum (ETH) is poised for potential significant growth due to an impending supply shock. This week’s events highlight the dynamic and often unpredictable nature of the crypto landscape.

XRP’s Dip: A Temporary Setback or Something More?

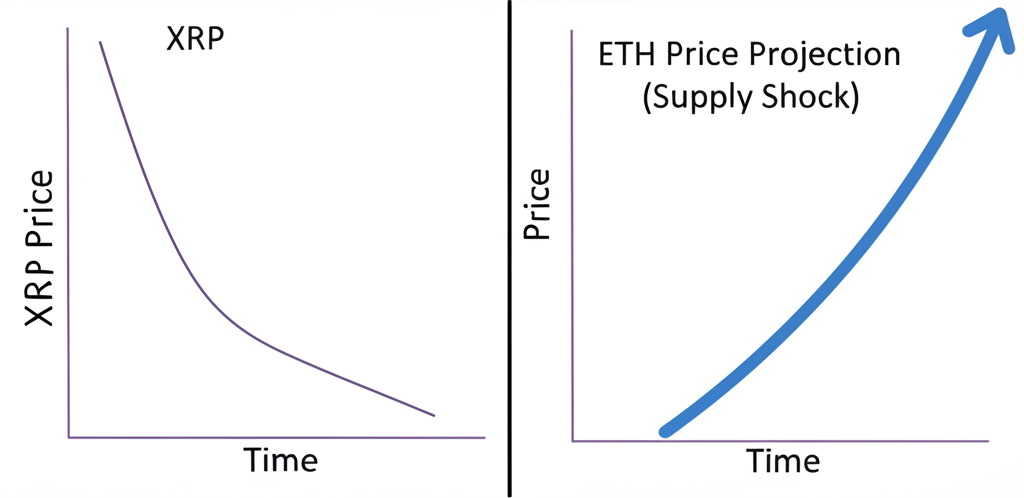

XRP, the native token of Ripple, experienced a noticeable price drop on Thursday, July 26th. However, several analysts viewed this not as a bearish signal, but rather as a necessary correction after a period of growth. The specific percentage drop wasn’t detailed in the Hodler’s Digest summary, but online research suggests a relatively modest decline compared to the overall market movement during that period. This interpretation suggests a healthy market mechanism at play, allowing for price stabilization before a potential further upward trend. Further research into trading volume and order book data would be necessary to confirm this analysis.

Understanding Market Corrections

Market corrections are normal occurrences in any market, including cryptocurrency. They represent a temporary pullback in price following an upward trend, providing opportunities for profit-taking and allowing the market to readjust before resuming its trajectory. The significance of any correction is determined by its depth and duration, and in this instance, analysts deemed XRP’s dip insignificant enough to not raise major red flags.

Ethereum’s Potential Outperformance: A Supply Shock on the Horizon?

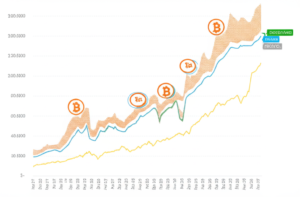

The Hodler’s Digest highlighted a bold prediction from Galaxy Digital’s CEO, suggesting Ethereum could surpass Bitcoin in performance within the next six months. This forecast hinges on a perceived “supply shock” related to ETH, likely referencing the upcoming Ethereum Shanghai upgrade and the unlocking of staked ETH.

The Impact of Staked ETH Unlocking

The Shanghai upgrade allows for the withdrawal of staked ETH, a significant event for the Ethereum network. While this initially might seem bearish, due to the potential influx of ETH into the market, some analysts believe it could lead to a long-term bullish effect. The reason is that this unlocked ETH might flow back into staking, creating demand and reducing the overall circulating supply. This, in turn, could lead to price appreciation. However, the actual impact will depend on various factors including market sentiment and overall adoption rates. We need to monitor market reaction to understand if this prediction holds water.

Other Notable News from the Week (July 20-26):

While the XRP correction and Ethereum’s potential were the primary focuses, the Hodler’s Digest likely included other significant market news that week. Without the full article text, a thorough review of other cryptocurrency news outlets from that period is needed to fully cover all events. This could include developments in regulatory frameworks, significant blockchain updates, or major partnerships affecting different crypto assets.

Summary:

- XRP experienced a minor price dip interpreted as a healthy correction.

- Galaxy Digital’s CEO predicts Ethereum will outperform Bitcoin in the next six months due to a potential supply shock.

- The unlocking of staked ETH after the Shanghai upgrade is a major factor influencing the Ethereum market.

- Other significant cryptocurrency news from July 20-26 would require further research.