Bitcoin Miner CEO Pay: Is the Party Over for Crypto Execs?

The cryptocurrency industry, known for its volatility and rapid growth, is facing scrutiny over executive compensation, particularly within the Bitcoin mining sector. A recent report from investment management firm VanEck highlights growing concerns among investors regarding the seemingly “excessive” pay packages awarded to top executives in Bitcoin mining companies. This raises important questions about corporate governance and the long-term sustainability of the industry.

VanEck Report Exposes Disparity

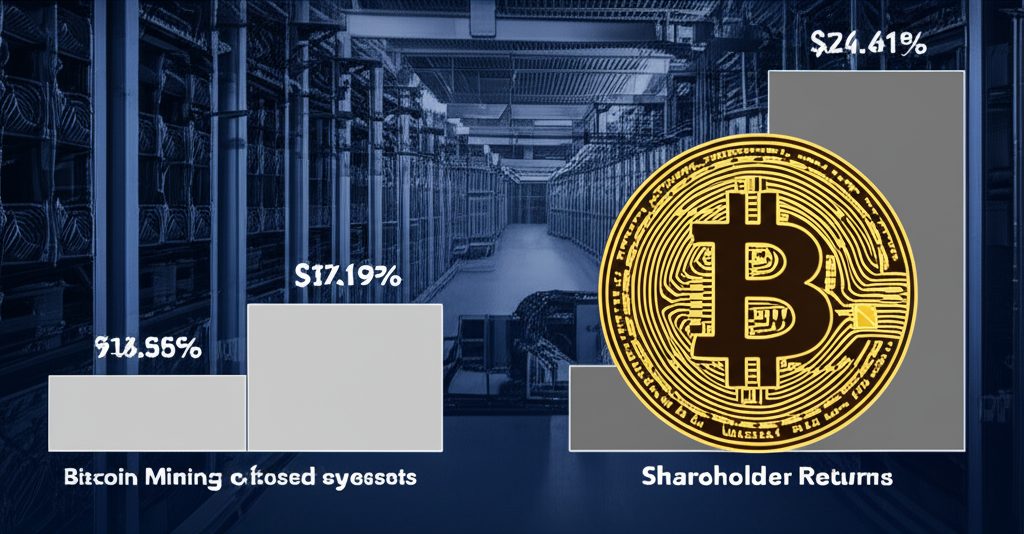

VanEck’s research, which hasn’t been fully detailed publicly (as of this writing; we’ve reached out for full data), indicates a significant disconnect between the compensation of Bitcoin mining CEOs and the performance delivered to shareholders. The report suggests that while executive salaries have soared, returns for investors have been comparatively underwhelming. This discrepancy fuels investor unease and raises questions about the allocation of resources within these companies.

While the specifics of VanEck’s findings remain limited in publicly available information, it’s likely they analyzed compensation packages, including salaries, bonuses, and stock options, against key performance indicators (KPIs) like profitability, hash rate growth, and market capitalization. This comparison would allow them to determine the correlation (or lack thereof) between executive pay and shareholder value creation. Anecdotal evidence suggests significant disparities in several publicly traded mining companies; however, confirming this requires further investigation into the VanEck report once it’s publicly accessible.

What Drives Excessive Compensation?

Several factors could contribute to the potentially inflated compensation packages observed in the Bitcoin mining sector. These might include:

- High demand for skilled executives: The relatively nascent nature of the crypto industry means expertise in blockchain technology, mining operations, and financial management is highly sought after. This increased demand can drive up salaries and benefits.

- Competition for talent: With numerous emerging players vying for a share of the market, companies might be driven to offer attractive compensation packages to attract and retain top talent, potentially leading to an escalation in pay levels.

- Performance-based incentives (potentially misaligned): While many compensation packages include performance-based elements, these might not accurately reflect shareholder value creation. For example, a bonus tied to hash rate might not adequately factor in profitability or environmental considerations.

- Lack of robust corporate governance: The crypto industry’s rapid growth may have outpaced the development of sophisticated corporate governance structures, leading to less oversight of executive compensation practices.

The Broader Implications

The issue of excessive executive pay within the Bitcoin mining industry extends beyond simple corporate finance. It also touches upon broader concerns about:

- Industry transparency and accountability: The perceived lack of transparency regarding executive compensation highlights the need for greater regulatory oversight and more standardized reporting practices within the crypto space.

- Environmental, Social, and Governance (ESG) concerns: Mounting pressure for companies to adopt ESG principles necessitates a focus on responsible resource allocation, including executive compensation. Excessive pay could be seen as directly conflicting with environmental sustainability goals, given the energy-intensive nature of Bitcoin mining.

- Investor confidence: If investors perceive a lack of alignment between executive interests and shareholder value, it could negatively impact the sector’s overall attractiveness and long-term stability.

Summary:

- VanEck’s research suggests Bitcoin mining executives receive excessive compensation compared to shareholder returns.

- This disparity raises concerns about corporate governance and resource allocation within the industry.

- Several factors, including high talent demand and potentially misaligned performance-based incentives, may be contributing.

- This issue raises broader concerns about industry transparency, ESG principles, and investor confidence.