21Shares Aims to Bring DeFi Exposure to the Masses with Spot ONDO ETF Filing

The cryptocurrency investment landscape is about to get a potential shakeup. 21Shares, a prominent provider of crypto exchange-traded products (ETPs), has filed a preliminary application with the U.S. Securities and Exchange Commission (SEC) for a spot exchange-traded fund (ETF) tracking the token of Ondo Finance, a decentralized finance (DeFi) platform. This move, if approved, would mark a significant step towards mainstream adoption of DeFi assets.

DeFi’s Entry into the Traditional Market

Ondo Finance, focusing on lending and borrowing protocols within the DeFi ecosystem, has gained recognition for its innovative approach to liquidity provision. By offering an ETF tracking its token, 21Shares aims to provide investors with regulated and easily accessible exposure to this burgeoning sector. This contrasts with the often complex and risky nature of directly interacting with DeFi protocols. The move strategically positions 21Shares to tap into the growing institutional interest in DeFi, a segment currently underserved by traditional investment vehicles.

Navigating the SEC Approval Process

The SEC’s approval process for crypto ETFs remains notoriously rigorous. Recent filings by other firms, including those seeking spot Bitcoin ETFs, have faced delays and scrutiny. While the outcome remains uncertain, the sheer fact of 21Shares’ filing demonstrates growing confidence in the potential of DeFi and the maturation of the cryptocurrency market. The success of this application could pave the way for further DeFi-related ETF listings, further blurring the lines between traditional and decentralized finance.

Potential Implications and Market Reaction

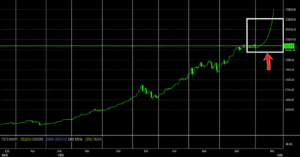

Assuming SEC approval, the 21Shares ONDO ETF could attract significant investment. The ETF’s structure offers a relatively low-risk entry point for institutional and retail investors seeking diversified exposure to the DeFi sector, potentially driving up the price of ONDO tokens. However, the price will also be influenced by broader market trends in the crypto space and the performance of Ondo Finance itself.

Similar filings, particularly those focusing on Bitcoin spot ETFs, have seen significant market interest, and a similar reaction is likely if the SEC grants 21Shares’ application. The potential influx of institutional capital could significantly impact the overall DeFi market capitalization.

21Shares ONDO ETF: Key Takeaways

- 21Shares filed a preliminary application with the SEC for a spot ETF tracking ONDO, the token of the DeFi platform Ondo Finance.

- This filing represents a significant step towards mainstream DeFi adoption and institutional investment.

- SEC approval remains uncertain, mirroring the ongoing scrutiny of crypto-related ETF applications.

- If approved, the ETF could significantly impact the price of ONDO tokens and broader DeFi market capitalization.

- The filing signals a growing confidence in the maturity and potential of the DeFi sector.